The Navient class action lawsuit has been a hot topic in the world of student loans, and for good reason. In 2022, Navient agreed to cancel a whopping $1.7 billion in private student loan debt for about 66,000 borrowers. As someone who’s seen friends struggle with student loan debt, I knew this was a story worth diving into.

![Average Student Loan Debt [2024]: by Year, Age & More](https://educationdata.org/wp-content/uploads/2567/average-student-loan-debt-2.png)

Source: Education Data Initiative

Let’s start at the beginning. Navient Corporation didn’t just appear out of thin air. It actually spun off from Sallie Mae back in 2014. Remember Sallie Mae? That name was practically synonymous with student loans for years. Well, Navient took over the federal loan servicing business and quickly became a major player in the student loan world.

Source: Wikipedia

But Navient’s rapid expansion came with some serious growing pains. By 2015, they had acquired $8.5 billion in student loan assets from Wells Fargo. The next year, they became one of the largest servicers of federal student loans. That’s when things started to get messy.

In 2017, the Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Navient. The allegations were pretty damning: deceptive practices in loan servicing, predatory lending tactics, and violations of consumer protection laws. It wasn’t just the CFPB either. Several state attorneys general jumped on board, filing their own lawsuits against the company.

Source: Student Connections

So, what exactly were these lawsuits alleging? Well, it’s a long list. Mishandling Public Service Loan Forgiveness applications, deceptively promoting co-signer release programs, failing to perform core loan servicing duties, steering borrowers into expensive repayment plans, and engaging in unfair and deceptive student loan servicing practices. That’s quite a rap sheet.

One case that really caught my attention was the Youssef v. Navient Solutions case. This wasn’t just another lawsuit – it was a class action suit that could potentially impact thousands of borrowers. The allegations were serious: Navient was accused of systematically misallocating payments, resulting in unnecessary interest charges and late fees for borrowers.

Source: YouTube

Now, class action lawsuits are tricky beasts. Getting class certification is a huge hurdle, and Navient fought hard against it. But the potential impact of this case on future litigation was massive. It opened the door for other borrowers to seek justice for similar issues.

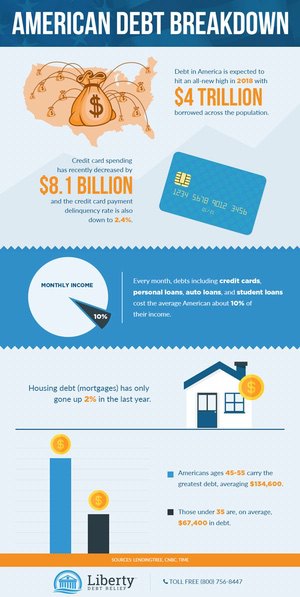

Fast forward to 2022, and we get to the big settlement. Navient agreed to a $1.85 billion settlement with state attorneys general. This wasn’t just about canceling debt – it also included changes in loan servicing practices and ongoing compliance monitoring. It was a game-changer for many borrowers.

Source: Liberty Debt Relief

But here’s the thing – not everyone affected by Navient’s practices was automatically eligible for relief. There was a whole process for identifying eligible borrowers and navigating the claims filing system. And let’s be real, dealing with student loan paperwork is about as fun as a root canal.

Consumer advocacy groups are playing a big role too. They’re not just educating borrowers about their rights – they’re lobbying for legislative changes to prevent these kinds of issues in the future.

And Navient? Well, let’s just say their reputation took a hit. The company has had to shift its corporate strategy, and shareholders are feeling the pinch. It’s a stark reminder that even big companies can face consequences for their actions.

But what about you, the borrower? What can you learn from all this? First and foremost, know your rights. Understanding your loan terms and repayment options is crucial. Income-driven repayment plans and loan forgiveness programs can be lifesavers if you know how to navigate them.

Stay informed and proactive. Regularly review your loan terms and statements. If something doesn’t look right, speak up. And don’t be afraid to file a complaint if you think your rights are being violated.

Financial literacy is key here. I can’t stress enough how important it is to understand the basics of personal finance, especially when it comes to student loans. Schools are starting to incorporate financial education into their curricula, which is a step in the right direction.

Technology is also playing a bigger role in loan management. There are apps and tools out there that can help you stay on top of your loans and avoid common pitfalls. Take advantage of them!

Now, let’s zoom out a bit and look at the bigger picture. The Navient case has sparked some serious conversations about student loan policies in general. There are proposals floating around for loan forgiveness and cancellation on a much larger scale.

We’re also seeing a shift in how people view for-profit education. There’s increased scrutiny on these institutions, and student perceptions are changing. It’s not just about getting a degree anymore – people are asking hard questions about the value and cost of their education.

If you’re dealing with student loan issues, remember that you’re not alone. There are resources and professionals out there who can help. At Ultra Law, we specialize in protecting consumers’ rights, including those affected by unfair student loan practices. Don’t hesitate to reach out for a consultation if you’re feeling overwhelmed.

And hey, while we’re on the topic of legal challenges, you might want to check out our guide on navigating the aftermath of accidents in Las Vegas. While it’s focused on bus accidents, many of the principles apply to handling any legal challenge, including student loan issues.

The Navient case is a stark reminder of the complexities and potential pitfalls in the student loan system. But it’s also a story of accountability and change. As we move forward, it’s crucial that we continue to advocate for fair practices and transparent policies in higher education financing.

Remember, knowledge is power. Stay informed, know your rights, and don’t be afraid to speak up if something doesn’t seem right. Your financial future is worth fighting for.

Learnings Recap

- The Navient case highlights the importance of understanding your student loan terms and repayment options

- Staying informed and proactive about your loans can help prevent issues and identify potential problems early

- Financial literacy plays a crucial role in making informed decisions about education financing

- The student loan landscape is evolving, with new policies and alternative financing models emerging

- If you’re facing challenges with your student loans, seeking professional legal advice can help protect your rights

The Navient saga has sent shockwaves through the higher education financing landscape. It’s not just about one company’s missteps – it’s a wake-up call for the entire industry. As we dig deeper into the implications, it’s clear that the ripple effects will be felt for years to come.

Let’s talk about regulatory reforms. The Consumer Financial Protection Bureau (CFPB) isn’t messing around. They’ve rolled out new guidelines for loan servicers that are tighter than a drum. We’re talking enhanced disclosure requirements, stricter oversight on payment processing, and a zero-tolerance policy for deceptive practices.

But it’s not just the feds stepping up. States are flexing their consumer protection muscles too. California, for instance, passed the Student Borrower Bill of Rights in 2020. This law puts loan servicers under a microscope, requiring them to be licensed and setting strict standards for how they interact with borrowers.

Consumer advocacy groups are having a field day with all this. They’re not just sitting back and watching – they’re in the trenches, educating borrowers about their rights and options. Organizations like the Student Borrower Protection Center are running workshops, creating online resources, and even offering one-on-one counseling to help borrowers navigate the complex world of student loans.

These groups are also hitting the halls of Congress, lobbying for legislative changes. They’re pushing for everything from expanded loan forgiveness programs to caps on interest rates. It’s a David vs. Goliath battle, but they’re making some serious noise.

Now, let’s talk about Navient’s business model. The company’s reputation took a nosedive faster than a lead balloon. Trust is the currency of the financial services industry, and Navient’s account is looking pretty depleted. They’ve had to pivot hard, shifting away from federal loan servicing and focusing more on private loans and business processing services.

This shift hasn’t gone unnoticed by shareholders. Navient’s stock price has been on a roller coaster ride, and not the fun kind. Investors are asking tough questions about the company’s long-term viability in a more heavily regulated environment.

But enough about the big players – what does all this mean for you, the borrower? First off, it’s crucial to understand your rights. The Navient case has shone a spotlight on some shady practices, but it’s also highlighted the protections that borrowers have.

Income-driven repayment plans are a prime example. These plans can be a lifesaver if you’re struggling to make your monthly payments. They adjust your payment based on your income and family size, potentially lowering your monthly bill significantly. But here’s the kicker – many borrowers don’t even know these options exist.

Loan forgiveness programs are another area where knowledge is power. Public Service Loan Forgiveness (PSLF) has been in the news a lot lately, and for good reason. If you work in a qualifying public service job and make 120 qualifying payments, you could have the rest of your federal student loans forgiven. That’s huge!

But here’s the rub – these programs can be tricky to navigate. The paperwork is enough to make your head spin, and one small mistake could set you back years. That’s why it’s crucial to stay on top of your loans and not be afraid to ask for help when you need it.

Speaking of staying on top of things, let’s talk about the importance of regularly reviewing your loan terms and statements. It’s not exactly a thrilling way to spend an afternoon, but it could save you thousands in the long run. Look for any discrepancies in your balance, interest rates, or payment history. If something looks off, don’t hesitate to reach out to your servicer for clarification.

And if you’re not satisfied with their response? That’s where knowing how to file a complaint comes in handy. The CFPB has a complaint portal that’s easy to use and can get results. State attorneys general offices are also good resources for consumer complaints.

Now, let’s zoom out and look at the bigger picture of higher education financing. The Navient case has sparked some serious soul-searching about how we fund higher education in this country. There are proposals floating around for everything from targeted loan forgiveness to free public college.

One idea that’s gaining traction is income share agreements (ISAs). Instead of taking out a traditional loan, students agree to pay a percentage of their income for a set number of years after graduation. It’s an interesting concept that ties the cost of education more directly to its economic value.

The for-profit education sector is also under the microscope. These institutions have long been criticized for aggressive recruiting tactics and poor outcomes for students. The Navient case has only intensified this scrutiny. We’re seeing increased accountability measures and a shift in student perceptions. More and more students are questioning whether the high price tag of for-profit schools is really worth it.

As we wrap up this deep dive into the Navient case and its implications, it’s clear that we’re at a crossroads in higher education financing. The old system is creaking under its own weight, and change is inevitable. But what that change will look like is still up for debate.

One thing’s for sure – financial literacy is more important than ever. Whether you’re a high school student considering college, a current borrower navigating repayment, or a parent helping your kids plan for their future, understanding the ins and outs of student loans is crucial.

Schools are starting to get the message. We’re seeing more financial literacy programs popping up in high schools and colleges. These programs cover everything from budgeting basics to the nitty-gritty of student loan repayment. It’s a start, but there’s still a long way to go.

Technology is also playing a bigger role in loan management. There are apps out there that can help you track your loans, explore repayment options, and even simulate different career paths to see how they might affect your ability to repay your loans. It’s like having a financial advisor in your pocket.

But at the end of the day, there’s no substitute for good old-fashioned research and due diligence. Before you sign on the dotted line for any student loan, make sure you understand exactly what you’re getting into. Read the fine print, ask questions, and don’t be afraid to shop around for better terms.

And if you do find yourself in over your head? Don’t panic. There are resources out there to help. From non-profit credit counseling services to legal aid organizations, you have options. The key is to act early and be proactive.

The Navient case may have been a black eye for the student loan industry, but it’s also been a catalyst for change. As we move forward, it’s crucial that we continue to push for transparency, fairness, and accountability in higher education financing. After all, education is supposed to open doors, not close them with a mountain of debt.

Remember, your financial future is in your hands. Stay informed, be proactive, and don’t be afraid to speak up if something doesn’t seem right. The student loan system may be complex, but with the right knowledge and tools, you can navigate it successfully.