In 2020, the Mr. Cooper Group faced a massive class action lawsuit involving over 340,000 borrowers. This case caught my attention while I was researching mortgage servicing practices, and as someone who’s dealt with home loans before, I know how important fair treatment is in this industry. Let’s dive into the details of this significant case and what it means for homeowners and the mortgage world.

The Genesis of the Lawsuit

The Mr. Cooper class action lawsuit started because of alleged problems in how Nationstar Mortgage (now Mr. Cooper Group) was handling mortgages. This legal action brought up several issues within the mortgage servicing industry, especially focusing on how big servicers manage customer accounts and follow regulations.

The lawsuit addressed multiple alleged violations of consumer protection laws and mortgage servicing regulations. Plaintiffs claimed there were issues with how payments were processed, how loan modifications were handled, and how foreclosures were carried out. It’s a complex web of allegations that really highlights the challenges in the mortgage servicing industry.

According to the settlement, Mr. Cooper agreed to pay $5.8 million to resolve claims that it violated mortgage servicing laws. This affected some borrowers who unfortunately lost their homes to foreclosure. It’s a sobering reminder of the real-world impact these practices can have on people’s lives.

Source: SlideTeam

Nationstar’s Transformation to Mr. Cooper

In 2017, Nationstar Mortgage went through a big change, rebranding itself as Mr. Cooper. This wasn’t just about slapping a new name on the company. It represented a shift in how they wanted to do business and treat their customers. The timing of this rebranding is interesting, given that it happened when the mortgage servicing industry was under increasing scrutiny.

The rebranding aimed to improve how customers saw the company and show that they were taking a more personal approach to mortgage servicing. Along with the name change, they made changes inside the company and updated their policies. I can’t help but wonder if this transformation influenced how they handled the legal challenges and communicated with the public during the lawsuit.

As part of the rebranding, Mr. Cooper introduced a new customer portal. This portal had improved features for transparency, making it easier for borrowers to keep track of their loan status and payment history. It’s a step in the right direction, but as we’ll see, there were still issues that needed to be addressed.

Brand Identity Shift

The change from Nationstar to Mr. Cooper wasn’t just about a new logo or color scheme. It was a deliberate effort to change how people saw the company and to reposition themselves in the competitive mortgage servicing market. This rebranding likely played a role in how they approached the lawsuit and communicated with affected customers.

The new brand identity put a big emphasis on being customer-focused and transparent. Their marketing efforts after the rebranding were all about rebuilding trust with consumers. I think it’s interesting to consider how this name change might have affected how plaintiffs and the public viewed the company during the legal proceedings. Did it make a difference? It’s hard to say for sure, but it certainly adds another layer to the story.

Source: Distinctive Bat

Corporate Culture Evolution

Along with the rebranding, Mr. Cooper made changes to its corporate culture. These shifts were aimed at aligning the company’s internal practices with its new public image. Understanding these changes gives us insight into how the company may have approached the lawsuit and the negotiations that followed.

They implemented new training programs to improve customer service quality. The company also revised its mission statement and core values to reflect a more customer-focused approach. Internal policies were updated to address some of the issues raised in the lawsuit. It’s a lot of change happening at once, and it makes me wonder how effective these measures were in actually improving their practices.

| Aspect | Before (Nationstar) | After (Mr. Cooper) |

|---|---|---|

| Brand Focus | Transaction-oriented | Customer-centric |

| Customer Service | Standard industry practices | Enhanced training and support |

| Technology | Legacy systems | Modernized digital platforms |

| Corporate Values | Profit-driven | Balance of profit and customer satisfaction |

Regulatory Landscape

The regulatory environment surrounding mortgage servicing played a crucial role in the Mr. Cooper class action lawsuit. There are various federal and state regulations that govern how mortgage servicers operate, and understanding this landscape is key to grasping the complexities of the case.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 had a significant impact on mortgage servicing regulations. This act was a response to the 2008 financial crisis and aimed to prevent similar issues in the future. It’s a complex piece of legislation, but its effects on the mortgage industry have been far-reaching.

In 2014, the Consumer Financial Protection Bureau (CFPB) established new servicing rules, further defining what servicers are responsible for. These rules cover everything from how servicers should communicate with borrowers to how they should handle loan modifications and foreclosures. It’s a lot for servicers to keep track of, and as we’ve seen with the Mr. Cooper case, not everyone gets it right.

On top of federal regulations, state-level regulations add another layer of complexity to compliance requirements. Each state has its own rules and requirements, which can make it challenging for nationwide servicers like Mr. Cooper to stay compliant across the board.

Recent developments show that regulatory challenges continue for Mr. Cooper. As reported by “National Mortgage News”, the company is currently suing its insurers over a cyber attack that resulted in $30 million in losses. This highlights the ongoing complexities in the mortgage servicing industry and the various risks these companies face.

CFPB’s Role

The Consumer Financial Protection Bureau (CFPB) played a significant role in the Mr. Cooper case. As the primary federal regulator for consumer financial products and services, the CFPB’s involvement shaped the course of the lawsuit and the resulting settlement.

The CFPB conducted investigations into Mr. Cooper’s mortgage servicing practices. Their regulations set the standards against which Mr. Cooper’s practices were judged. It’s worth noting that the bureau’s enforcement actions against other servicers set precedents that influenced this case. The CFPB has been pretty active in the mortgage servicing space, and their involvement in this case is just one example of their ongoing efforts to protect consumers.

Source: Consumer Financial Protection Bureau

State-Level Regulations

In addition to federal oversight, state-level regulations added another layer of complexity to the Mr. Cooper class action lawsuit. Different states have varying requirements for mortgage servicers, which contributed to the intricacies of the case and the settlement negotiations.

State attorneys general played a role in bringing the lawsuit and negotiating the settlement. Some states have more stringent mortgage servicing regulations than federal standards. This can create a challenging environment for nationwide servicers like Mr. Cooper, who have to navigate multiple sets of rules.

Compliance with multiple state regulations presented challenges for Mr. Cooper. For example, California’s Homeowner Bill of Rights provides additional protections for borrowers facing foreclosure. Mr. Cooper had to navigate these state-specific rules alongside federal regulations, which is no small task.

From my perspective, this multi-layered regulatory environment highlights the need for robust compliance systems and a deep understanding of both federal and state laws. It’s a lot for any company to manage, but when you’re dealing with people’s homes and financial futures, getting it right is crucial.

The Nationstar Settlement

The settlement reached between Nationstar/Mr. Cooper and the plaintiffs marked a significant moment in the mortgage servicing industry. It addressed various alleged violations and set forth a plan for compensating affected borrowers and improving future practices.

The settlement included both monetary compensation and required changes in business practices. It’s not just about writing a check; it’s about changing how things are done moving forward. This kind of comprehensive settlement can have lasting effects on the industry as a whole.

The settlement benefits two specific groups of affected homeowners: the service transfer population and the property preservation population. The service transfer population includes borrowers whose loans were transferred to Nationstar between February 1, 2011, and December 18, 2017, and became delinquent within 90 days, resulting in foreclosure. It’s a specific group, but it represents a significant number of people who were potentially harmed by the company’s practices.

Source: Carolina Law

Settlement Structure

The structure of the Nationstar settlement was multifaceted, addressing both immediate compensation for affected borrowers and long-term changes in the company’s practices. This comprehensive approach aimed to resolve past issues and prevent future violations.

The settlement included a substantial monetary fund for compensating affected borrowers. But it’s not just about the money. Non-monetary remedies were a significant part of the settlement, focusing on future compliance. This is crucial because it’s not enough to just pay for past mistakes; there needs to be a plan to prevent them from happening again.

The agreement established mechanisms for ongoing monitoring and reporting of Mr. Cooper’s practices. This is important because it provides accountability and ensures that the company follows through on its commitments. It’s one thing to agree to make changes; it’s another to actually implement them and stick to them over time.

Source: YouTube

Non-Monetary Remedies

Beyond financial compensation, the settlement required Mr. Cooper to implement various non-monetary remedies. These changes aimed to address the root causes of the alleged violations and improve the company’s mortgage servicing practices moving forward.

The settlement mandated specific improvements in customer service protocols. New systems were required to be implemented for better tracking and resolution of customer complaints. The company agreed to enhanced staff training programs focused on compliance and customer service. These are all steps in the right direction, but the real test will be in how effectively they’re implemented and maintained over time.

| Remedy Type | Description | Impact |

|---|---|---|

| Customer Service | Improved response times and resolution processes | Enhanced borrower satisfaction |

| Compliance Systems | New software for tracking regulatory requirements | Reduced risk of future violations |

| Staff Training | Comprehensive programs on regulations and best practices | Improved handling of borrower issues |

| Reporting | Regular updates to regulators on compliance efforts | Increased transparency and accountability |

Long-Term Impact Assessment

The settlement included provisions for assessing its long-term impact on Mr. Cooper’s practices and the broader mortgage servicing industry. This forward-looking approach aimed to ensure lasting improvements beyond the immediate resolution of the lawsuit.

An independent monitor was appointed to oversee Mr. Cooper’s compliance with the settlement terms. This is a crucial step in ensuring accountability. Regular reporting requirements were established to track progress and identify any ongoing issues. The settlement included provisions for adjusting practices based on the findings of these long-term assessments.

I think this long-term approach is smart. It’s not enough to just make changes in the short term; there needs to be ongoing evaluation and adjustment to ensure that the improvements stick and that new issues don’t crop up over time.

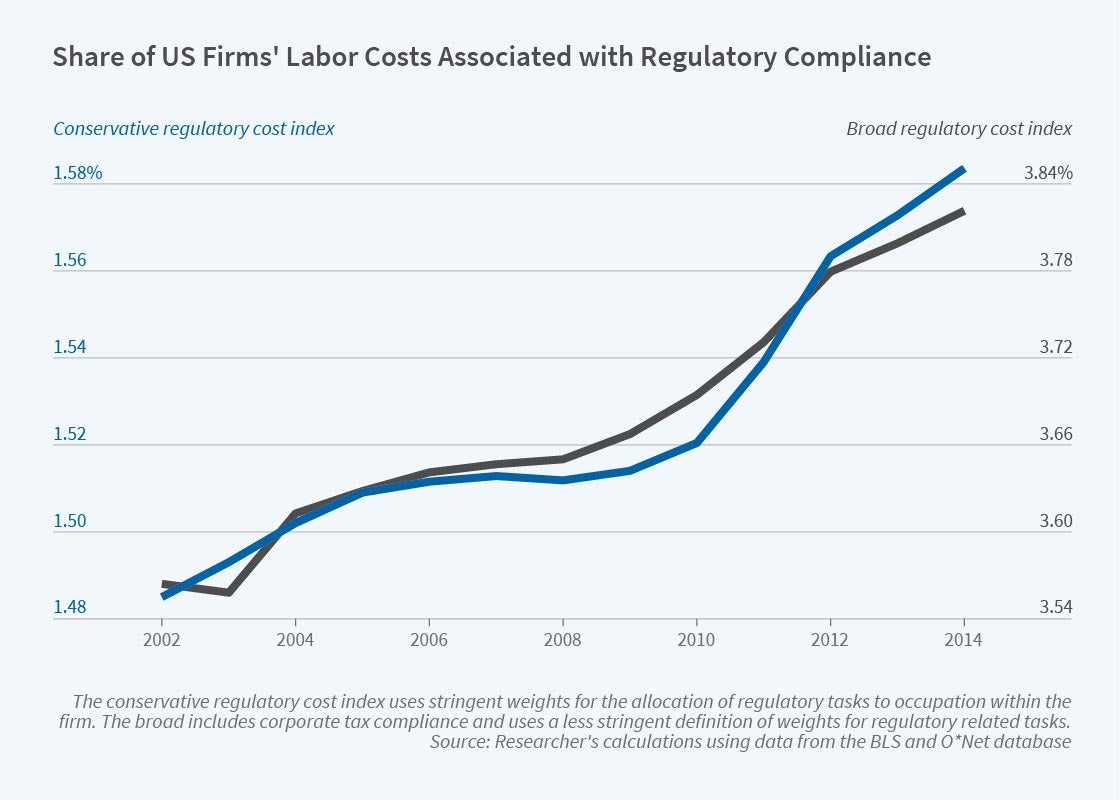

Source: National Bureau of Economic Research

Claimant Eligibility and Process

A crucial aspect of the settlement was determining who was eligible for compensation and how they could claim it. The process was designed to be as inclusive and straightforward as possible, while still maintaining necessary verification steps.

Eligibility criteria were established based on specific time periods and types of alleged violations. A claims administrator was appointed to manage the process and distribute funds. Multiple communication channels were used to inform potential claimants about the settlement. This multi-pronged approach is important because it helps ensure that as many affected borrowers as possible are aware of their rights and the compensation available to them.

The deadline for borrowers to submit a claim form for the Nationstar Mortgage servicing settlement is March 3, 2025. This gives affected borrowers ample time to come forward, which I think is important given the complexity of these issues and the fact that some people might not immediately realize they’re eligible.

Documentation Requirements

To participate in the settlement, claimants needed to provide specific documentation. These requirements were designed to verify eligibility while not placing an undue burden on affected borrowers.

Claimants typically needed to provide proof of their mortgage relationship with Nationstar/Mr. Cooper. Additional documentation might be required depending on the specific violation claimed. The settlement included provisions for assisting borrowers who had difficulty obtaining necessary documents. This is crucial because navigating the paperwork can be overwhelming, especially for people who might have lost their homes or experienced financial hardship.

For instance, a borrower claiming improper foreclosure might need to provide copies of foreclosure notices, correspondence with Mr. Cooper, and proof of ownership during the relevant time period. It’s a lot to keep track of, but it’s necessary to ensure that the right people are being compensated.

Claim Filing Strategies

For eligible borrowers, understanding how to effectively file a claim was crucial. The settlement included resources and guidance to help claimants navigate the process and maximize their chances of receiving compensation.

A dedicated website and hotline were established to provide information and assistance to claimants. Step-by-step guides were created to walk borrowers through the claim filing process. Deadlines were clearly communicated, with reminders sent to potential claimants. These resources are important because the process can be confusing, and many people might not know where to start or what they need to do.

Source: Creately

For more information on navigating complex legal claims, see our guide on handling head-on collision settlements. While the specifics differ, many of the principles of documentation and claim filing apply to various types of legal settlements.

Industry-Wide Implications

The Mr. Cooper class action lawsuit and its settlement have had far-reaching implications for the mortgage servicing industry. This case has set new precedents and highlighted areas where industry practices may need to evolve.

The case has influenced how other mortgage servicers approach compliance and customer service. It’s not just about Mr. Cooper anymore; other companies are looking at this case and adjusting their own practices to avoid similar issues. Regulatory bodies have used insights from this case to refine their oversight approaches. This means we might see changes in how the industry is regulated moving forward.

The ongoing impact of the Mr. Cooper case is evident in recent events. According to “HousingWire”, Mr. Cooper and ACI Payments are expected to settle another lawsuit related to unauthorized mortgage payments by September 30. This demonstrates the continued scrutiny on mortgage servicing practices and shows that the issues raised in the original lawsuit are still relevant today.

Precedent Setting

The resolution of the Mr. Cooper class action lawsuit has established important benchmarks for future cases in the mortgage servicing sector. These precedents will likely shape how similar issues are addressed, both legally and operationally.

The case has set standards for what constitutes acceptable mortgage servicing practices. Future lawsuits against mortgage servicers may reference this case in their arguments. The structure of this settlement could serve as a template for resolving similar disputes in the industry.

Legal Interpretation Evolution

This case has contributed to a shift in how courts and regulators interpret mortgage servicing regulations. This evolution in legal interpretation could have lasting effects on industry operations and consumer rights protection.

The lawsuit has clarified certain ambiguities in existing mortgage servicing regulations. Courts now have a more nuanced understanding of the challenges faced by both servicers and borrowers. This evolving interpretation could influence future regulatory updates and enforcement actions.

Industry Best Practices

In the wake of the Mr. Cooper lawsuit, new industry best practices are emerging. These practices aim to prevent similar problems in the future and address the issues highlighted by the case.

Many servicers are revamping their internal audit and compliance processes. There’s an increased focus on transparency in communication with borrowers. Significant technology investments are being made to improve accuracy and efficiency in servicing operations.

Consumer Advocacy Impact

The Mr. Cooper class action lawsuit has significantly influenced consumer advocacy efforts in the mortgage industry. It has empowered individual borrowers and advocacy groups to assert their rights more effectively and push for industry improvements.

Consumer advocacy groups have utilized the case to highlight systemic issues in mortgage servicing. The lawsuit has provided a framework for identifying and addressing potential violations. There’s increased collaboration between advocacy groups and regulatory bodies in monitoring industry practices.

Increased Awareness

A key outcome of the Mr. Cooper case has been heightened public awareness about mortgage servicing practices and borrower rights. This increased awareness is changing how consumers interact with their mortgage servicers.

Educational campaigns have been launched to inform borrowers about their rights and servicer obligations. More borrowers are actively monitoring their mortgage accounts and questioning discrepancies. There’s growing demand for clear, accessible information about mortgage servicing practices.

Advocacy Strategy Shifts

Consumer advocacy groups are adapting their strategies based on lessons learned from the Mr. Cooper case. These shifts are likely to influence how future issues in the mortgage servicing industry are addressed.

Advocacy groups are increasingly using data analysis to identify potential systemic issues. There’s a growing focus on preventative measures rather than just reactive responses to violations. Collaborative approaches between advocacy groups, regulators, and industry players are becoming more common.

The Role of Technology in Mortgage Servicing Compliance

The Mr. Cooper class action lawsuit has underscored the critical role that technology plays in ensuring compliance with mortgage servicing regulations. As the industry evolves, technological solutions are becoming increasingly important in preventing errors and improving service quality.

Advanced software systems are being developed to automate compliance checks. Data analytics are being used to identify potential issues before they escalate.

Source: Django Stars

Automation and Error Prevention

In response to issues highlighted by cases like the Mr. Cooper lawsuit, the mortgage servicing industry is increasingly turning to automation to prevent errors and ensure compliance. These technological solutions aim to reduce human error and improve the accuracy of servicing operations.

Machine learning algorithms are being employed to detect anomalies in servicing processes. Automated workflow systems are streamlining operations and reducing the risk of missed steps. Real-time compliance checking tools are being integrated into servicing platforms.

AI-Driven Compliance Checks

Artificial Intelligence (AI) is emerging as a powerful tool for ensuring compliance in mortgage servicing. AI-driven systems can analyze vast amounts of data quickly, identifying potential compliance issues that might be missed by human reviewers.

Natural Language Processing is being used to analyze customer communications for potential issues. Predictive models are helping servicers anticipate and prevent compliance risks. AI systems are being trained on historical data to recognize patterns indicative of non-compliance.

Blockchain for Transparency

Blockchain technology is being explored as a potential solution for improving transparency and reducing disputes in mortgage servicing. Its ability to create immutable records could address many of the record-keeping issues highlighted in cases like the Mr. Cooper lawsuit.

Blockchain could provide a tamper-proof record of all transactions and communications. Smart contracts on blockchain platforms could automate certain servicing processes. The technology could facilitate easier auditing and regulatory compliance checks.

Data Privacy Concerns

As mortgage servicers increasingly rely on technology to improve compliance, data privacy has become a critical concern. Balancing the need for comprehensive data analysis with the protection of sensitive consumer information is a key challenge facing the industry.

New data encryption methods are being implemented to protect consumer information. Access control systems are being refined to ensure data is only available on a need-to-know basis. Regular security audits are becoming standard practice in the industry.

Regulatory Framework for Data Use

The use of consumer data in mortgage servicing is subject to a complex regulatory framework. Understanding and complying with these regulations is crucial for servicers as they implement new technological solutions.

Regulations like the GDPR and CCPA have global implications for data handling in mortgage servicing. Industry-specific regulations are being updated to address the use of AI and big data analytics. Servicers are developing comprehensive data governance policies to ensure compliance.

Consumer Control Over Data

Empowering consumers with greater control over their financial data is becoming a key focus in the mortgage servicing industry. This shift is partly in response to issues highlighted by cases like the Mr. Cooper lawsuit.

Self-service portals are being enhanced to give borrowers more access to their loan data. Opt-in/opt-out mechanisms for data sharing are becoming more sophisticated. Some servicers are exploring the concept of “data wallets” to give consumers more control over their information.

While Ultra Law specializes in personal injury cases rather than mortgage servicing litigation, the Mr. Cooper class action lawsuit underscores the importance of having dedicated legal representation when facing large corporations. If you’re dealing with a complex legal situation involving a big company, whether it’s a personal injury case or another type of dispute, having a knowledgeable advocate on your side can make all the difference.

At Ultra Law, we’re committed to providing client-first service, transparency, and relentless advocacy. Our approach ensures that you have the support you need to navigate challenging legal situations. We operate on a contingency fee basis, which means you don’t pay unless we win your case. This model aligns with the spirit of class action lawsuits, allowing individuals to seek justice without the burden of upfront legal costs.

If you’re facing a legal challenge and need expert representation, don’t hesitate to reach out. Contact Ultra Law today for a free consultation. Let us put our experience and dedication to work for you.

For more information on how we approach complex legal cases, see our guide on navigating brain injury settlements. While the specifics differ, our commitment to client advocacy remains constant across all types of cases.

Learnings Recap

- The Mr. Cooper class action lawsuit highlights the complexities of mortgage servicing regulations and the potential consequences of non-compliance.

- The case has led to significant changes in industry practices, including improved customer service, enhanced compliance measures, and increased use of technology.

- Consumer awareness and advocacy have been strengthened as a result of this lawsuit, empowering borrowers to better understand and assert their rights.

- The settlement structure, including both monetary and non-monetary remedies, provides a template for addressing systemic issues in the financial services industry.

- Technological advancements, particularly in AI and blockchain, are playing an increasingly important role in ensuring compliance and transparency in mortgage servicing.