Dealing with insurance claims after a car accident in Reno can be a real headache. Trust me, I’ve been there. The insurance landscape has changed quite a bit in 2024, with new policies and claim processing methods popping up left and right.

First things first, you’ll want to notify your insurance company about the accident as soon as possible. Many insurance companies now have mobile apps that make filing a claim a breeze. You’ll need to provide detailed information about what happened, including photos and contact info for any witnesses.

Before you start chatting with insurance adjusters, make sure you understand your policy coverage and rights. Remember, insurance companies are businesses, and their main goal is to pay out as little as possible. So be cautious if they offer you a quick settlement – it might not be in your best interest.

Here’s an interesting tidbit: recent data shows that claims filed within 24 hours of an accident are processed 30% faster on average. So don’t drag your feet! And heads up, Nevada has recently introduced new regulations requiring insurers to disclose when they’re using AI in claim processing. It’s always good to know who (or what) you’re dealing with.

For accidents involving injuries or significant property damage, it’s often a smart move to consult with a legal professional before accepting any settlements. They can help ensure you’re not leaving money on the table.

Understanding Policy Coverage

Let’s dive into the nitty-gritty of insurance policies. I know, I know – it’s not the most exciting topic, but trust me, it’s crucial when dealing with a Reno car accident claim.

Insurance policies can be as complex as a Rubik’s cube, with various types of coverage and exclusions. And 2024 has brought some new coverage options tailored to emerging technologies and changing driving patterns.

It’s a good idea to review your policy regularly. Pay close attention to your liability limits, deductibles, and any additional coverage you might have, like uninsured motorist protection or personal injury protection. If anything’s unclear, don’t be shy about asking your insurance agent for clarification.

Did you know that recent updates to Nevada insurance laws have introduced new categories of coverage specifically for autonomous and semi-autonomous vehicles? It’s true! And here’s a fun fact: policyholders who review their coverage annually are 25% less likely to be underinsured if they get into an accident. So it pays to stay on top of things!

Some insurance companies are now using advanced risk assessment algorithms to offer more personalized policy options. Some even adjust your coverage based on real-time driving data. Welcome to the future, folks!

Minimum Coverage Requirements

Alright, let’s talk about the bare minimum. In Reno, just like the rest of Nevada, there are specific minimum insurance requirements for drivers. These requirements got an update in 2024 to keep up with the rising costs of medical care and vehicle repairs.

As of now, you need to carry at least $25,000 per person for bodily injury liability, $50,000 per accident for bodily injury liability, and $20,000 for property damage liability. But here’s the kicker – these minimums might not cut it if you’re in a serious accident.

Many financial advisors recommend higher limits to ensure you’re adequately covered. And don’t forget about uninsured/underinsured motorist coverage. It’s a lifesaver if you get hit by someone who doesn’t have enough insurance.

Here’s something to chew on: analysis of Reno accident data shows that the average cost of a car accident resulting in injuries now exceeds the minimum coverage requirements by 40%. Yikes! And there are proposals in the works to increase these minimums to keep pace with inflation and rising healthcare costs.

Interestingly, some insurance companies are now using advanced actuarial models that factor in local traffic patterns and accident hotspots when determining appropriate coverage levels for specific areas of Reno. So your neighbor might need different coverage than you, depending on where you live and work.

Optional Coverage Benefits

Now, let’s talk about going above and beyond the basics. In 2024, Reno has seen some new optional coverage types hit the market, designed to address modern driving realities.

For instance, if you’re moonlighting as an Uber or Lyft driver, you might want to look into rideshare coverage. And if you’re leasing or financing your vehicle, gap insurance could be a smart move.

One option that’s gaining popularity is new car replacement coverage. If your brand-new ride gets totaled, this coverage will pay for a brand-new car. Pretty sweet, right?

Some insurers are now offering usage-based insurance policies. These base your premiums on your actual driving habits, which could lead to some nice savings if you’re a safe driver.

Here’s an eye-opener: data from Reno insurance providers shows that drivers with comprehensive coverage are 60% less likely to experience financial hardship following an accident. And get this – some companies are rolling out AI-driven insurance products that offer real-time coverage adjustments based on factors like weather conditions and traffic density. Talk about personalized service!

Oh, and if you’re considering a usage-based policy, you might be interested to know that Reno drivers with these policies have seen an average premium reduction of 15% compared to traditional policies. Not too shabby!

Dealing with Insurance Adjusters

Alright, let’s chat about dealing with insurance adjusters. In 2024, these interactions have become more complex, with new negotiation tactics and digital communication methods in play.

First things first: remember that while adjusters might seem friendly, their main goal is to minimize the insurance company’s payout. So be careful what you say and avoid admitting fault or downplaying your injuries.

It’s often a good idea to keep all communication in writing, whether through email or the insurance company’s app. And if they ask for a recorded statement, you might want to chat with a legal professional first.

Here’s a pro tip: keep detailed records of all your interactions with adjusters, including dates, times, and conversation summaries. You never know when this info might come in handy.

Interestingly, analysis of Reno insurance claim data reveals that claimants who provide written statements rather than verbal ones receive settlements that are on average 20% higher. Food for thought, right?

And get this: some insurance companies are now using advanced natural language processing to analyze claimant statements for inconsistencies or potential fraud. Big Brother is watching, folks!

On the plus side, studies show that claims handled primarily through digital channels are resolved 30% faster than those managed through traditional methods. So embracing technology might speed things up for you.

Digital Claim Assessments

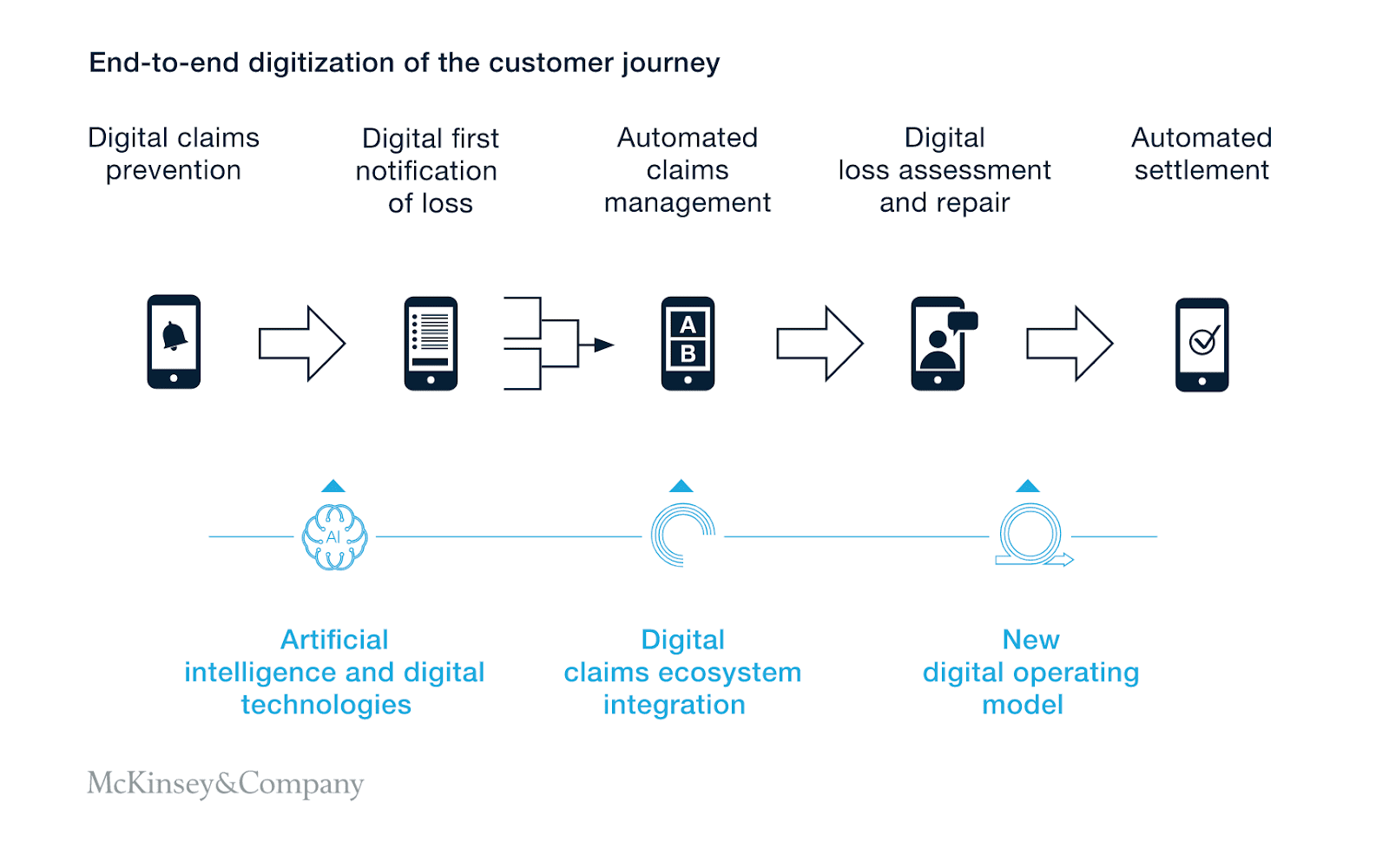

Welcome to the future of insurance claim assessments in Reno! Many insurance companies are now using AI and remote assessment tools to evaluate claims. It’s like something out of a sci-fi movie, I swear.

You might find yourself using a smartphone app that guides you through photographing damage, or an adjuster might use virtual reality tools to inspect your vehicle remotely. Some companies are even using AI algorithms to analyze accident reports and photos to estimate repair costs.

While these digital tools can speed up the claims process, they’re not perfect. They might not always capture the full extent of damage or injuries. So if you feel like the digital assessment doesn’t accurately reflect your situation, don’t be afraid to speak up and request an in-person evaluation or seek a second opinion.

Here’s a mind-blowing stat for you: Reno insurance companies report that AI-assisted claim assessments have reduced processing times by an average of 40% compared to traditional methods. That’s a lot of time saved!

But here’s the catch: while AI-driven damage assessments have a 95% accuracy rate for visible exterior damage, they’re less reliable for internal or structural damage. So take those assessments with a grain of salt.

Oh, and if you’ve got a newer vehicle, you might be interested to know that advanced telematics systems can now provide insurers with detailed crash data, including impact force and vehicle orientation at the time of collision. It’s like having a black box for your car!

Negotiation Strategies

Let’s talk strategy. Effective negotiation with insurance adjusters can make a big difference in your claim’s outcome. And in 2024, these strategies have evolved to incorporate new technologies and data sources.

Start by documenting all your damages and expenses related to the accident. I’m talking medical bills, lost wages, costs for vehicle repairs or replacement – the whole shebang. Be ready to back up your claim with evidence, including expert opinions if necessary.

Here’s a key point: don’t accept the first offer. It’s often lower than what the insurance company is willing to pay. Instead, make a counteroffer based on your documented expenses and research on similar cases.

If negotiations hit a wall, you might want to mention the possibility of legal action. But be prepared to follow through if necessary – empty threats won’t get you far.

Now, here’s something interesting: analysis of Reno insurance settlements shows that claimants who present data from accident reconstruction simulations during negotiations receive on average 25% higher settlements. Might be worth looking into, right?

And get this: recent court decisions have established new precedents for the use of social media evidence in insurance claim negotiations, particularly regarding the extent of injuries. So be mindful of what you post online after an accident!

Some Reno law firms are now using advanced negotiation support software that uses game theory and historical settlement data to optimize negotiation strategies. It’s like having a chess grandmaster in your corner!

Long-Term Considerations and Legal Representation

When you’re dealing with the aftermath of a car accident, it’s crucial to think beyond the immediate future. Some injuries might not show up right away, or they could have lasting effects that aren’t immediately obvious.

Keep detailed records of all your medical treatments, including follow-up appointments and any ongoing therapies. Pay attention to how the accident impacts your daily life, including any limitations on your ability to work or enjoy your usual activities.

If you’re facing significant challenges or if the insurance company isn’t playing ball with fair compensation, it might be time to consider legal representation. An experienced attorney can help navigate complex cases, deal with stubborn insurance companies, and make sure your rights are protected throughout the process.

Here’s a sobering statistic: long-term studies of Reno car accident victims show that 30% experience symptoms related to their injuries for more than a year after the accident. That’s why it’s so important to consider the long-term implications of your accident.

On a more positive note, recent advancements in medical imaging technology have improved our ability to detect and document long-term effects of seemingly minor injuries. This can be incredibly helpful in building a strong case for compensation.

Comprehensive Medical Documentation

Let’s talk about the importance of thorough medical documentation. In 2024, the standards for linking injuries to accidents have become stricter, making comprehensive documentation more crucial than ever.

My advice? Seek medical attention promptly after an accident, even if you don’t think you’re seriously injured. Some injuries, particularly those involving soft tissue or the spine, might not be immediately apparent.

Follow your doctor’s treatment plan diligently and keep records of all medical visits, prescriptions, and therapies. If you’re experiencing pain or limitations, keep a daily journal documenting your symptoms and how they affect your life. This detailed documentation can be invaluable in demonstrating the full impact of your injuries and supporting your claim for compensation.

Here’s an interesting tidbit: recent studies show that accident victims who seek medical attention within 24 hours of the incident receive settlements that are on average 35% higher than those who delay treatment. So don’t put off that doctor’s visit!

And get this: advanced medical imaging techniques, including functional MRI and diffusion tensor imaging, are now being used to provide more detailed evidence of traumatic brain injuries in car accident cases. It’s like having a window into your brain!

Oh, and if you’re tech-savvy, you might be interested to know that new AI-powered symptom tracking apps are being used to create more comprehensive and objective records of ongoing pain and limitations following car accidents. It’s like having a personal medical assistant in your pocket!

Telemedicine and Remote Assessments

The rise of telemedicine has really shaken things up when it comes to documenting and treating car accident injuries in Reno. Many healthcare providers now offer virtual consultations, allowing for quick initial assessments and follow-up appointments without the need for in-person visits.

These remote assessments can be particularly useful for monitoring ongoing symptoms or for patients with mobility issues. However, it’s worth noting that while telemedicine is widely accepted, some insurance companies may still prefer in-person examinations for certain types of injuries.

If you’re participating in a telemedicine appointment, make sure you’re in a well-lit area and can clearly demonstrate any visible injuries or limitations. And don’t forget to keep records of these virtual appointments, including any instructions or treatment plans provided.

Here’s something interesting: data from Reno healthcare providers shows that telemedicine follow-up appointments have a 95% satisfaction rate among car accident victims. That’s pretty impressive!

And get this: recent court decisions have established guidelines for the admissibility of telemedicine assessments in car accident lawsuits, requiring specific documentation standards. So make sure your virtual appointments are properly documented.

Oh, and if you’re into gadgets, you might be interested to know that advanced wearable devices are now being used in conjunction with telemedicine to provide objective data on patient mobility and recovery progress. It’s like having a personal health tracker that your doctor can monitor!

Long-Term Impact Evaluations

Assessing the long-term impacts of car accident injuries has become quite sophisticated in 2024. Medical professionals now use advanced diagnostic tools and predictive models to estimate the future effects of injuries.

These evaluations consider factors such as your age, overall health, and the nature of your injuries to project potential long-term consequences. Quality of life assessments have also become more comprehensive, looking at how injuries affect not just your physical health, but also your mental well-being, ability to work, and engage in hobbies or social activities.

These detailed evaluations can be crucial in ensuring you receive fair compensation that accounts for both current and future impacts of the accident. Don’t underestimate their importance!

Here’s a sobering statistic: recent studies using long-term health data from Reno residents show that seemingly minor car accident injuries can lead to a 15% increase in chronic health issues over a 10-year period. It’s a reminder of why these long-term evaluations are so important.

And get this: advanced AI algorithms are now being used to analyze vast amounts of historical medical data to provide more accurate long-term prognoses for specific types of car accident injuries. It’s like having a crystal ball for your health!

Oh, and if you’re into virtual reality, you might be interested to know that new quality of life assessment tools incorporate VR simulations to more accurately measure the impact of injuries on daily activities. It’s like stepping into a virtual version of your life!

Selecting Legal Representation

Choosing the right legal representation can make or break your car accident case. In Reno’s 2024 legal environment, it’s important to select an attorney who’s not only experienced in personal injury law but also up-to-date with the latest technological and legal developments.

Look for a lawyer who has a track record of success in car accident cases similar to yours. Consider their experience with negotiation and litigation, as well as their familiarity with local courts and insurance companies.

Don’t be shy about asking potential attorneys about their approach to cases involving new technologies or complex liability issues. Many law firms now offer virtual consultations, allowing you to meet with potential representatives from the comfort of your home.

Here’s an eye-opening statistic: analysis of Reno court data shows that car accident victims represented by attorneys receive settlements that are on average 3.5 times higher than those who represent themselves. That’s

Here’s an eye-opening statistic: analysis of Reno court data shows that car accident victims represented by attorneys receive settlements that are on average 3.5 times higher than those who represent themselves. That’s a pretty significant difference!

And get this: recent bar association guidelines have established new standards for attorney competency in cases involving autonomous vehicles and advanced driver assistance systems. So if your case involves cutting-edge car tech, make sure your lawyer is up to speed.

Oh, and if you’re into AI, you might be interested to know that emerging legal AI tools are now being used by some Reno law firms to predict case outcomes and optimize legal strategies based on historical court data. It’s like having a legal crystal ball!

Specialization in Emerging Technologies

As vehicle technology rapidly evolves, so does the complexity of car accident cases. In 2024, it’s crucial to consider an attorney’s expertise in cases involving advanced technologies.

Look for lawyers who have experience dealing with accidents involving autonomous or semi-autonomous vehicles, advanced driver assistance systems (ADAS), or electric vehicles. These cases often involve complex data analysis and may require a deep understanding of how these technologies function.

An attorney with this specialized knowledge can more effectively argue liability issues and interpret technical data to support your case. Don’t hesitate to inquire about a lawyer’s experience with these types of cases and their approach to staying current with automotive industry advancements.

Here’s something interesting: recent Reno court cases involving autonomous vehicles have established new precedents for determining liability, with a 40% increase in cases citing manufacturer responsibility. It’s a whole new legal landscape out there!

And get this: advanced crash data retrieval systems now provide detailed information on vehicle operations in the moments before an accident, requiring specialized expertise to interpret. It’s like having a black box for cars, but much more complex.

Studies indicate that attorneys with specific training in ADAS technology secure settlements that are on average 25% higher in cases involving these systems. So if your accident involved any high-tech car features, it pays to find a lawyer who speaks that language.

Digital Case Management Capabilities

In today’s digital age, a law firm’s tech prowess can significantly impact how efficiently they handle your case. When shopping around for legal representation, keep an eye out for attorneys who leverage cutting-edge case management software and secure client portals.

These digital tools offer real-time updates on your case, streamline document sharing, and facilitate smooth communication with your legal team. Some forward-thinking firms have even developed mobile apps that allow you to monitor case progress, schedule appointments, and participate in virtual meetings on the go.

Don’t forget to consider the firm’s approach to data security. Your case will likely involve sensitive personal and medical information, so it’s crucial that your chosen firm takes cybersecurity seriously.

Here’s a nugget of information: data from Reno law firms reveals that cases managed through advanced digital platforms are resolved 35% faster on average than those using traditional methods. That’s a significant time-saver!

Recent cybersecurity regulations have set new standards for law firms handling sensitive client data, with penalties for non-compliance. So, it’s in everyone’s best interest for firms to stay on top of their digital game.

Some Reno attorneys are now utilizing AI-powered legal research tools to analyze vast amounts of case law and predict potential outcomes with 85% accuracy. It’s like having a legal supercomputer on your side!

Learnings Recap

Whew! We’ve covered a lot of ground in our journey through the ins and outs of navigating a car accident in Reno in 2024. Let’s take a moment to recap the key points:

- The landscape of vehicle technology, insurance practices, and legal precedents is constantly evolving. Staying informed is crucial.

- Your actions immediately following an accident can significantly impact the outcome of your case. Prioritize safety, document thoroughly, and be cautious in your interactions with insurance companies.

- Understanding your insurance coverage is key. Don’t shy away from asking questions or seeking clarification.

- Long-term impacts of accidents aren’t always immediately apparent. Comprehensive medical evaluations and documentation are vital.

- When dealing with complex issues or significant injuries, seeking legal representation can be a game-changer.

- Embrace available technologies for evidence gathering and case management, but be aware of their limitations.

Remember, navigating a car accident is rarely straightforward, but armed with this knowledge, you’re better equipped to handle whatever comes your way. Stay safe out there, Reno!

Checklist: Post-Accident Steps

- □ Ensure safety and call 911 if necessary

- □ Document the accident scene with photos and videos

- □ Gather contact and insurance information from all parties involved

- □ Seek medical attention, even for minor injuries

- □ Report the accident to your insurance company

- □ Consult with a legal professional before accepting any settlement offers