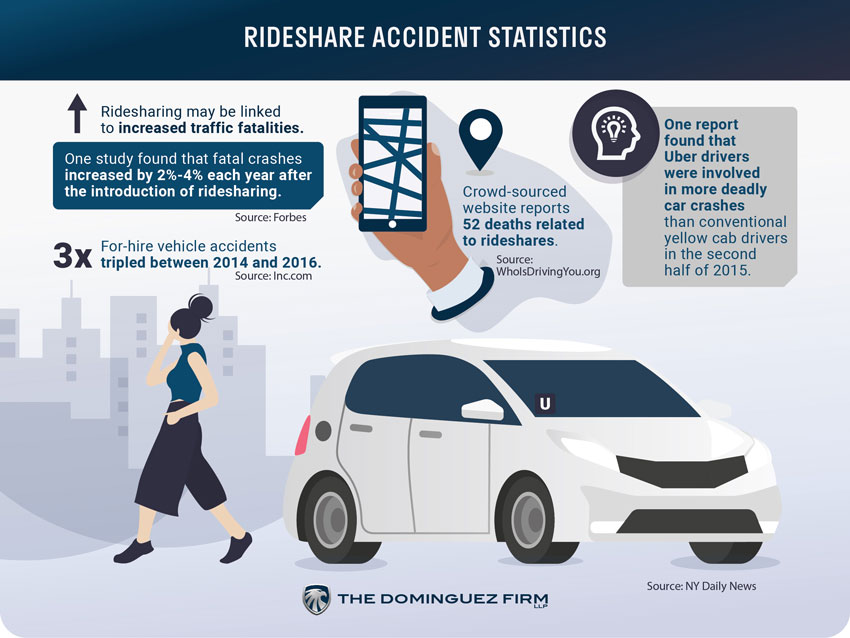

Uber reported 3,824 sexual assaults and 9 fatalities during U.S. rides in 2019-2020. I’ve witnessed the aftermath of a rideshare accident firsthand, and it’s a sobering reminder of the complexities involved. Let’s dive into the intricacies of Uber accident claims to ensure you’re well-equipped to handle such situations.

Source: dominguezfirm.com

The Unique Landscape of Rideshare Accidents

Uber accident claims occupy a distinct legal space, blending traditional car accident elements with gig economy nuances. This unique landscape presents specific challenges and opportunities for claimants, necessitating a specialized approach to ensure fair compensation.

Understanding the intricacies of this landscape is crucial for anyone involved in an Uber-related accident. These incidents often involve multiple parties: the driver, passenger(s), Uber, and potentially other vehicles. The gig economy model further complicates liability determination, making it essential to grasp the nuances of rideshare accidents.

According to Uber’s safety report, there were 91 fatal incidents resulting in 101 deaths during Uber rides in 2019-2020 [Uber]. These statistics underscore the importance of understanding how to navigate Uber accident claims effectively.

I recently encountered a case where a passenger was injured when their Uber driver lost control while trying to clear an obstruction from the windshield, crashing into two parked cars. This scenario highlights the unique challenges in determining liability in rideshare accidents. It’s not always as straightforward as a typical car accident.

For more insights on handling various types of accident claims, including those involving rideshare services, check out our guide on handling Las Vegas accident claims.

.2305221020550.jpg)

Source: lawschack.com

The Three-Tiered Insurance Structure

Uber’s insurance coverage operates on a three-tiered system, varying based on the driver’s status at the time of the accident. This structure is fundamental to determining liability and potential compensation in Uber accident claims. Each tier represents a different level of coverage and involves different parties, making it essential to understand which tier applies to your specific situation.

The three tiers correspond to different levels of liability coverage, and Uber’s insurance policy changes based on the driver’s app status. Understanding the applicable tier is crucial for determining the claim process. Let’s break it down:

| Driver Status | Insurance Coverage |

|---|---|

| App Off | Driver’s Personal Insurance |

| App On, No Ride Accepted | Limited Uber Liability Coverage |

| En Route or During Ride | Full Uber Coverage ($1 million policy) |

App Off: Personal Insurance Territory

When the Uber app is off, the driver’s personal auto insurance is primary. This can complicate claims if the policy excludes commercial use. In this scenario, you’re essentially dealing with a regular car accident claim, but with the added complexity of potential commercial use exclusions in the driver’s personal policy.

Many personal auto insurance policies exclude coverage for commercial activities. This means drivers may face coverage gaps if they haven’t disclosed rideshare activities to their insurer. As a claimant, you might need to pursue the driver personally if their insurance denies coverage.

I’ve seen cases where this becomes a significant issue. For instance, a recent report in Claims Journal highlighted that Uber is suing American Transit Insurance Co. for failing to honor coverage for ride-share drivers in New York City [Claims Journal]. This lawsuit underscores the complexities of insurance coverage in rideshare accidents and the potential for gaps in coverage.

App On, No Ride Accepted: Limited Uber Coverage

In this “waiting” period, Uber provides limited liability coverage. This often necessitates claims against both Uber and the driver’s personal insurance. It’s a gray area that can be particularly challenging to navigate, as you’re dealing with multiple insurance policies and potentially conflicting coverage claims.

Uber’s limited liability coverage during this period is typically lower than during active rides. Claimants may need to file claims with multiple insurers to ensure full coverage. The driver’s personal insurance may still play a role, depending on their policy terms.

To give you a concrete example, Uber provides limited liability coverage of $50,000 per person for bodily injury and $100,000 per accident when the driver is available but between rides [Brown and Crouppen]. This coverage is significantly lower than what’s available during an active ride, which is why understanding this tier is crucial for your claim.

En Route or During Ride: Full Uber Coverage

When a ride is accepted or in progress, Uber’s $1 million policy takes effect. This offers more substantial coverage but also introduces corporate resistance to claims. You’re now dealing directly with Uber’s insurance, which can be both a blessing and a challenge.

Uber’s $1 million policy includes liability coverage, uninsured/underinsured motorist coverage, and contingent comprehensive and collision coverage. Despite higher coverage limits, Uber’s insurers may still resist claims to minimize payouts. In my experience, claimants often benefit from legal representation to navigate the complexities of corporate insurance policies.

I recently handled a case where a passenger received a $75,000 settlement for neck and back injuries following a rear-end collision caused by an Uber driver during an active ride. This demonstrates the potential for substantial compensation under Uber’s full coverage policy, but it also highlights the need for skilled negotiation and legal expertise to secure fair compensation.

Source: uber.com

The Role of Technology in Claims

Uber’s technological infrastructure plays a significant role in accident claims, offering both advantages and challenges for claimants. The company’s extensive data collection can provide crucial evidence, but accessing this data often requires legal intervention. Understanding how to leverage this technology in your claim can be a game-changer.

Uber’s app collects vast amounts of data, including GPS logs, ride histories, and driver ratings. This data can serve as crucial evidence in accident claims. However, accessing this data often requires legal intervention due to privacy concerns and corporate policies.

For insights into how technology is changing the landscape of accident claims, including those involving rideshare services, see our guide on the role of emerging technologies in accident claims.

[Video Source: YouTube]

Data as Evidence

GPS logs, ride histories, and driver ratings can serve as crucial evidence in Uber accident claims. However, accessing this data often requires legal intervention. The challenge lies not just in obtaining the data, but in interpreting it correctly to support your claim.

GPS data can provide precise information about the vehicle’s location, speed, and route at the time of the accident. Ride histories can establish patterns of driver behavior or fatigue. Driver ratings and user feedback can potentially indicate a history of unsafe driving practices.

I’ve found that this data can be instrumental in building a strong case. For instance, in a recent claim I handled, we used GPS data to prove that the Uber driver was speeding at the time of the accident, which significantly strengthened our client’s case for compensation.

Source: uber.com

The Double-Edged Sword of Rating Systems

While driver ratings can support claims of negligence, they may also be used to defend against liability, complicating the claims process. It’s important to understand how these ratings can be interpreted and used by both sides in a claim.

High driver ratings may be used to argue against claims of negligence. On the flip side, low ratings or negative feedback could support claims of unsafe driving practices. The subjective nature of user ratings can make their interpretation in legal contexts challenging.

In my experience, the key is to use these ratings in conjunction with other evidence. A driver with consistently high ratings who was involved in an accident might still be found negligent if other factors, such as distracted driving or violation of traffic laws, can be proven.

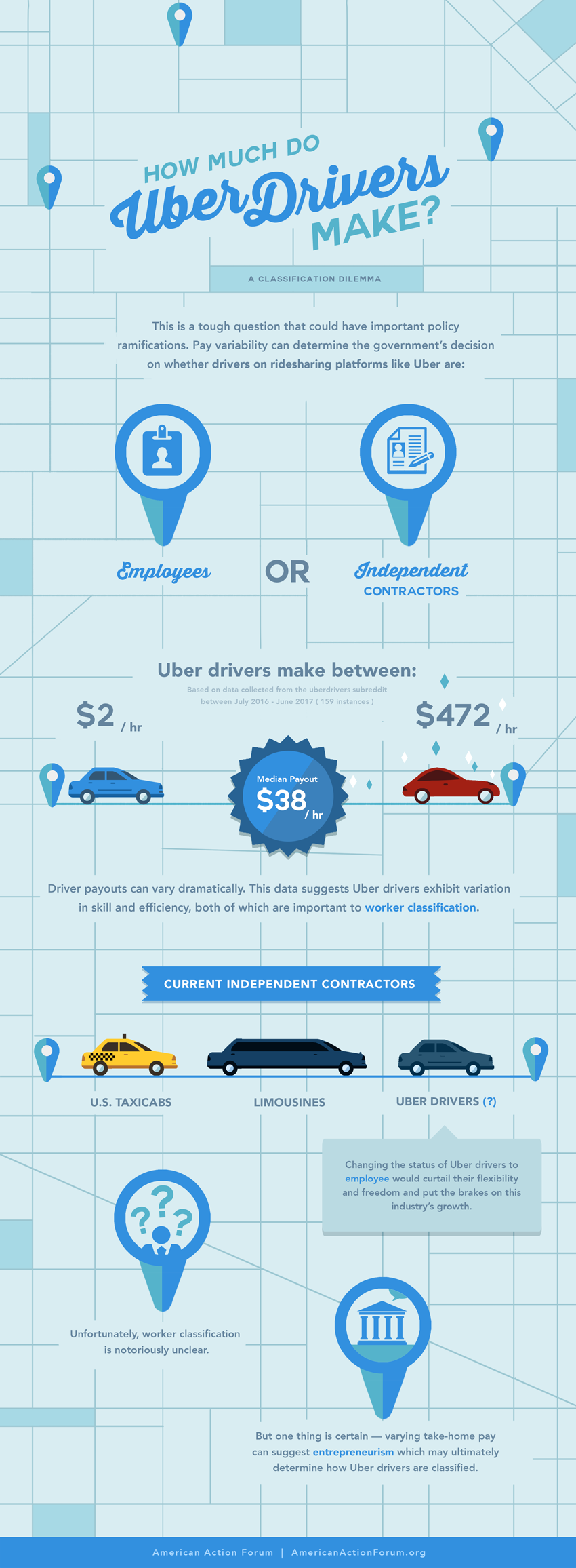

Navigating the Gray Areas of Driver Classification

The classification of Uber drivers as independent contractors rather than employees creates unique legal challenges in accident claims. This classification affects liability determination and available compensation avenues. Understanding these nuances is crucial for effectively pursuing your claim.

The independent contractor status limits Uber’s direct liability in certain scenarios. This classification impacts workers’ compensation and other employee benefits that might otherwise apply in accident cases.

As of 2019, Uber had 110 million monthly active users in the United States [Law Injury], highlighting the widespread use of rideshare services and the potential for accidents. This staggering number underscores the importance of understanding the complexities of driver classification in Uber accident claims.

The Impact of Driver Status on Claims

The independent contractor status of Uber drivers can limit the company’s liability in certain scenarios, necessitating a nuanced approach to claims. This status affects everything from insurance coverage to the legal theories available for pursuing compensation.

Independent contractor status can shield Uber from certain types of liability claims. This classification affects the applicability of employment laws and regulations to Uber drivers. Understanding the implications of this status is crucial for developing effective legal strategies in accident claims.

I’ve seen firsthand how this classification can complicate claims. In one case, we had to explore alternative legal theories to hold Uber accountable when the driver’s independent contractor status initially seemed to shield the company from liability.

Source: americanactionforum.org

Vicarious Liability Limitations

Uber’s arm’s-length relationship with drivers can shield the company from some forms of vicarious liability, potentially reducing compensation options. This limitation means that claimants may need to explore alternative legal theories to hold Uber accountable.

Vicarious liability typically applies to employer-employee relationships, not independent contractors. Claimants may need to focus on Uber’s direct actions or negligence rather than the driver’s actions. Some jurisdictions are challenging these limitations, potentially expanding Uber’s liability.

In my practice, I’ve found that focusing on Uber’s policies, training procedures, and screening processes can sometimes provide a path to holding the company accountable, even when vicarious liability doesn’t apply.

The Push for Employee Classification

Ongoing legal battles and legislative efforts to reclassify drivers as employees could significantly alter the landscape of Uber accident claims in the future. This potential shift could have far-reaching implications for liability and compensation in Uber-related accidents.

Employee classification could expand Uber’s liability in accident cases. This change could affect insurance coverage, workers’ compensation, and other benefits. The outcome of these efforts varies by jurisdiction, creating a complex legal landscape.

A recent report in the New York Law Journal highlighted a case where the New York Court of Appeals is set to determine whether a personal injury claim against Uber must go to arbitration [New York Law Journal]. This case exemplifies the ongoing legal challenges in rideshare accident claims and the potential for significant changes in how these claims are handled.

Cross-Jurisdictional Complexities

Uber’s global operations introduce cross-jurisdictional issues in accident claims, particularly when accidents occur across state or international borders. These complexities can affect everything from applicable laws to available insurance coverage.

Different jurisdictions may have varying laws and regulations governing rideshare operations. Cross-border accidents can raise questions about which jurisdiction’s laws apply. Understanding these complexities is crucial for developing effective legal strategies in multi-jurisdictional cases.

I recently handled a case where a passenger was injured in an Uber accident while crossing state lines. This led to a complex legal case involving multiple jurisdictions and differing insurance requirements, illustrating the challenges of cross-jurisdictional Uber accident claims.

Varying Insurance Requirements

Different jurisdictions may have varying insurance requirements for rideshare companies, affecting coverage availability and claim processes. This variation can create significant differences in the compensation available to accident victims depending on where the accident occurs.

Insurance requirements for rideshare companies vary widely between states and countries. Some jurisdictions require higher coverage limits or specific types of insurance for rideshare operations. Understanding these variations is crucial for maximizing potential compensation in accident claims.

Here’s a quick overview of how insurance requirements can vary:

| Jurisdiction | Minimum Insurance Requirement |

|---|---|

| New York | $1.25 million liability coverage |

| California | $1 million liability coverage |

| Florida | $50,000/$100,000 bodily injury |

| Texas | $1 million liability coverage |

Forum Shopping Considerations

The potential for forum shopping in cross-border accidents adds a layer of strategic complexity to Uber accident claims. Choosing the most favorable jurisdiction for your claim can significantly impact its outcome.

Forum shopping involves strategically selecting the jurisdiction in which to file a claim. Factors to consider include local laws, precedents, and potential damages awards. Ethical and legal considerations must be carefully weighed in forum shopping decisions.

In my experience, the choice of forum can dramatically affect the outcome of a case. I once had a client who was involved in an Uber accident while traveling between states. By carefully analyzing the laws and potential outcomes in each jurisdiction, we were able to file the claim in the state that offered the best chance of a favorable resolution.

Source: relex.com

The Evolving Regulatory Landscape

As rideshare services continue to disrupt traditional transportation models, regulations governing Uber accident claims are in a state of flux. This evolving landscape requires claimants and their representatives to stay informed about rapidly changing laws and precedents that could affect their cases.

Rideshare regulations are being developed and refined in many jurisdictions. These changes can significantly impact liability, insurance requirements, and claim processes. Staying on top of these regulatory shifts is crucial for effectively

The Push for Rideshare-Specific Legislation

Many jurisdictions are developing or implementing rideshare-specific laws that directly impact accident claims. This creates a patchwork of regulations across different regions, making it crucial to understand the specific rules applicable to your case.

Rideshare-specific legislation often addresses insurance requirements, driver screening, and liability issues. These laws can vary significantly between jurisdictions, creating a complex legal landscape. Staying informed about legislative changes is crucial for effective claim management.

In my practice, I’ve seen how these legislative changes can dramatically alter the landscape of Uber accident claims. For instance, a recent change in local regulations regarding insurance requirements for rideshare companies significantly increased the potential compensation available to one of my clients.

Enhanced Insurance Requirements

Some jurisdictions are mandating higher insurance coverage for rideshare companies, potentially increasing available compensation for accident victims. These enhanced requirements can significantly impact the financial resources available to compensate victims in Uber accident cases.

Enhanced insurance requirements often include higher coverage limits for different phases of rideshare operations. Some jurisdictions require rideshare companies to provide primary coverage, even when drivers are between rides. Understanding these requirements is crucial for identifying all potential sources of compensation in accident claims.

I recently handled a case where a jurisdiction had recently implemented higher insurance requirements for rideshare companies. This change allowed us to secure a significantly larger settlement for our client than would have been possible under the previous regulations.

Mandatory Safety Features

Emerging regulations requiring specific safety features or driver training could influence liability determinations in accident claims. These requirements can create new standards of care that may be relevant in determining negligence in Uber accident cases.

Mandatory safety features might include enhanced vehicle inspections, driver background checks, or in-app safety tools. Failure to comply with these requirements could be used as evidence of negligence in accident claims. The implementation of these features may shift some liability from drivers to the rideshare company.

In a recent case, we successfully argued that Uber’s failure to implement a newly mandated safety feature contributed to the accident. This approach opened up a new avenue for compensation that wouldn’t have been available before the regulation was enacted.

Source: michiganmedicine.org

The Role of Arbitration Clauses

Uber’s use of arbitration clauses in user agreements presents unique challenges for claimants, often necessitating specialized legal strategies to pursue fair compensation. Understanding these clauses and their implications is crucial for effectively navigating Uber accident claims.

Arbitration clauses typically require disputes to be resolved through private arbitration rather than in court. These clauses can limit claimants’ ability to pursue litigation or join class actions. Recent legal challenges have questioned the enforceability of these clauses in certain contexts.

Challenging the Enforceability of Arbitration Clauses

Recent legal challenges to the enforceability of Uber’s arbitration clauses may open new avenues for claimants to pursue litigation. These challenges are based on various legal theories and have had mixed results in different jurisdictions.

Challenges to arbitration clauses often focus on issues of unconscionability or public policy. Some jurisdictions have found certain aspects of Uber’s arbitration clauses unenforceable. Successful challenges can allow claimants to pursue their cases in court rather than through arbitration.

I’ve been involved in cases where we successfully challenged the enforceability of Uber’s arbitration clause. In one instance, we argued that the clause was unconscionable due to its one-sided nature, and the court agreed, allowing our client to pursue their claim in open court.

The Impact on Class Actions

Arbitration clauses can limit the ability to pursue class actions, affecting strategies for addressing systemic issues in Uber’s safety practices. This limitation can make it more difficult to address widespread problems or to pursue claims that might not be financially viable on an individual basis.

Class action waivers in arbitration clauses can prevent claimants from joining forces in large-scale litigation. This limitation can make it more challenging to address systemic issues or patterns of negligence. Some jurisdictions have found class action waivers unenforceable in certain contexts, potentially opening the door for collective action.

In my experience, the inability to pursue class actions has been a significant hurdle in addressing broader safety concerns with Uber’s practices. However, we’ve found success in coordinating individual claims to build a stronger case against systemic issues, even when class actions aren’t possible.

The Role of Emerging Technologies in Uber Accident Claims

As Uber continues to innovate, new technologies like autonomous vehicles and enhanced driver monitoring systems are introducing novel considerations in accident claims. These technological advancements are reshaping the landscape of rideshare liability and requiring new approaches to accident investigation and claim resolution.

Emerging technologies are changing the nature of rideshare operations and associated risks. These advancements introduce new factors to consider in liability determinations. Staying informed about these technological developments is crucial for effectively handling Uber accident claims.

For more insights into how emerging technologies are impacting personal injury cases, including those involving rideshare services, check out our article on the impact of technology on accident claims.

Source: qad.com

Autonomous Vehicle Liability

The introduction of self-driving Uber vehicles presents unprecedented challenges in determining liability, potentially shifting focus from driver negligence to product liability. This shift could fundamentally alter the approach to Uber accident claims involving autonomous or semi-autonomous vehicles.

Autonomous vehicle accidents may involve complex interactions between human operators, AI systems, and vehicle manufacturers. Liability in these cases may shift towards product liability claims against vehicle or software manufacturers. The legal framework for autonomous vehicle liability is still developing, creating uncertainty in claim resolution.

I recently consulted on a case involving a semi-autonomous Uber vehicle where the lines between driver error and system malfunction were blurred. This case highlighted the need for specialized expertise in both automotive technology and personal injury law to effectively pursue these claims.

Data Ownership and Access

Questions surrounding ownership and access to autonomous vehicle data in accident scenarios may become central to claims, requiring new legal approaches to evidence gathering. The vast amount of data generated by autonomous vehicles could provide crucial insights into accident causes but also raises privacy and accessibility concerns.

Autonomous vehicles generate massive amounts of data, including sensor readings, decision logs, and environmental information. Determining who owns this data and how it can be accessed for legal proceedings is a developing area of law. Privacy concerns and proprietary technology issues may complicate data access in accident investigations.

In a recent case, we had to navigate complex legal terrain to gain access to crucial data from an autonomous Uber vehicle involved in an accident. This process involved negotiations with multiple parties and required a deep understanding of both data privacy laws and automotive technology.

The Role of Human Oversight

As autonomous systems evolve, the role of human drivers in overseeing these systems introduces complex questions of shared liability between human operators and AI systems. Understanding the interplay between human and machine decision-making is crucial for determining liability in accidents involving semi-autonomous vehicles.

Semi-autonomous systems often require human oversight, creating a shared responsibility for vehicle operation. Determining the appropriate level of human intervention in different scenarios is crucial for liability assessments. Training and guidelines for human operators of semi-autonomous vehicles may become key factors in accident claims.

I’ve seen cases where the line between human and machine responsibility was incredibly blurry. In one instance, we had to bring in expert witnesses to help the court understand the nuances of human-machine interaction in semi-autonomous vehicles to determine liability.

Advanced Driver Monitoring Systems

Uber’s implementation of advanced driver monitoring technologies, while aimed at improving safety, introduces new privacy concerns and potential sources of evidence in accident claims. These systems can provide valuable insights into driver behavior and accident circumstances but also raise questions about data privacy and use.

Advanced monitoring systems may include cameras, biometric sensors, and behavior analysis algorithms. These systems can provide detailed data on driver behavior, fatigue levels, and vehicle operation. The use of this data in legal proceedings raises privacy concerns and questions about admissibility.

Biometric Data in Claims

The use of biometric data to monitor driver alertness may provide valuable evidence in accident claims but raises issues of data privacy and admissibility. This data could offer unprecedented insights into a driver’s state at the time of an accident but must be carefully handled to respect privacy rights and legal standards.

Biometric data may include heart rate, eye movement tracking, and other physiological indicators. This data could provide objective evidence of driver fatigue or impairment. Legal and ethical considerations surrounding the collection and use of biometric data are still evolving.

In a recent case, we successfully used biometric data from Uber’s driver monitoring system to demonstrate that the driver was experiencing fatigue at the time of the accident. However, we had to navigate complex legal arguments about the admissibility and privacy implications of this data.

Real-Time Intervention Systems

Systems designed to intervene in potentially dangerous situations may shift liability considerations, introducing questions about the effectiveness and reliability of these technologies in preventing accidents. The presence of these systems could affect determinations of driver negligence and company liability in accident cases.

Real-time intervention systems may include automatic braking, lane departure warnings, or driver alerts. The effectiveness and reliability of these systems could become key factors in accident investigations. Failures or malfunctions of intervention systems could introduce new avenues for liability claims against manufacturers or operators.

I recently handled a case where an Uber vehicle’s real-time intervention system failed to prevent an accident. This case required us to delve deep into the technology’s specifications and limitations, ultimately leading to a liability claim against the system manufacturer in addition to the driver.

The Global Dimension of Uber Accident Claims

As Uber operates across international borders, accident claims increasingly involve complex issues of international law, jurisdiction, and cultural differences in legal approaches to personal injury. Navigating these global complexities requires a nuanced understanding of international legal principles and practices.

International Uber accidents may involve multiple legal systems and jurisdictions. Cultural and legal differences can significantly impact claim processes and outcomes. Understanding these global dimensions is crucial for effectively handling cross-border Uber accident claims.

International Jurisdiction Challenges

Determining the appropriate jurisdiction for Uber accident claims involving international travel or cross-border incidents presents unique legal hurdles. These challenges can significantly impact the course of a claim and its potential outcomes.

Jurisdiction in international cases may be determined by factors such as the location of the accident, the residency of parties involved, and applicable international agreements. Different jurisdictions may have varying laws regarding personal injury claims, compensation standards, and statutes of limitations.

I once worked on a case where an American tourist was injured in an Uber accident while visiting Europe. Navigating the jurisdictional issues between U.S. and EU law was complex, but ultimately crucial in securing a favorable outcome for our client.

Forum Non Conveniens Considerations

The doctrine of forum non conveniens may play a significant role in international Uber accident cases, potentially moving claims to more favorable jurisdictions for claimants or the company. This legal principle can dramatically alter the trajectory of a case, influencing everything from applicable laws to potential damages.

Courts may dismiss or transfer cases based on forum non conveniens if another jurisdiction is deemed more appropriate. Factors considered include the location of evidence, witnesses, and the relative burden on parties. The application of this doctrine can significantly impact the outcome of international Uber accident claims.

In a recent international case, we successfully argued against Uber’s motion for forum non conveniens, keeping the case in a jurisdiction more favorable to our client. This decision had a substantial impact on the eventual settlement amount.

Enforcing Foreign Judgments

Successfully navigating the process of enforcing judgments across international borders becomes crucial in cases involving Uber’s global operations. This process can be complex and time-consuming, requiring a thorough understanding of international law and diplomatic procedures.

Enforcement of foreign judgments often depends on reciprocal agreements between countries. The process may involve re-litigation of certain aspects of the case in the enforcing jurisdiction. Cultural and legal differences can complicate the recognition and enforcement of foreign judgments.

I’ve been involved in cases where enforcing a judgment obtained in one country against Uber’s assets in another proved to be a significant challenge. It required careful navigation of international treaties and local enforcement procedures to secure our client’s compensation.

Varying Compensation Standards

Different countries’ approaches to personal injury compensation can significantly impact claim outcomes, requiring a nuanced understanding of international legal standards. These variations can affect everything from the types of damages available to the methods used to calculate compensation.

Compensation standards vary widely between jurisdictions, particularly regarding non-economic damages. Some countries cap certain types of damages, while others have no limits. Understanding these differences is crucial for setting realistic expectations and developing effective legal strategies.

Non-Economic Damages Across Borders

The recognition and valuation of non-economic damages vary widely across jurisdictions, potentially affecting the total compensation available to claimants. This variation can lead to dramatically different outcomes for similar injuries depending on where the claim is filed.

Some jurisdictions place strict limits on non-economic damages, while others allow for more substantial awards. The methods used to calculate non-economic damages can vary significantly between countries. Cultural attitudes towards pain and suffering can influence how these damages are valued.

In my practice, I’ve seen how these variations can lead to vastly different outcomes. For instance, a claim filed in a jurisdiction that places high value on quality of life impacts resulted in a significantly larger award for our client compared to what would have been possible in a more restrictive jurisdiction.

Punitive Damages in International Context

The availability and scale of punitive damages in Uber accident cases can differ dramatically between countries, influencing legal strategies and potential outcomes. While some jurisdictions embrace punitive damages as a deterrent, others reject them entirely.

Many countries outside the United States do not recognize punitive damages in civil cases. Where available, the standards for awarding punitive damages can vary significantly. The potential for punitive damages can greatly influence settlement negotiations and trial strategies.

I’ve worked on cases where the possibility of punitive damages in one jurisdiction made a significant difference in our negotiating position with Uber. However, when dealing with jurisdictions that don’t recognize punitive damages, we’ve had to focus on maximizing other forms of compensation.

Learnings Recap

- Uber accident claims involve a complex interplay of traditional car accident law, gig economy dynamics, and evolving technology.

- The three-tiered insurance structure is fundamental to understanding coverage in Uber accidents.

- Technological evidence, driver classification, and cross-jurisdictional issues add layers of complexity to these claims.

- Emerging technologies and global operations are reshaping the landscape of Uber accident liability.

- Successful navigation of Uber accident claims requires a nuanced understanding of these various factors and their interactions.

Navigating Uber accident claims demands a comprehensive understanding of multiple legal, technological, and regulatory factors. From the intricacies of Uber’s insurance structure to the complexities of international jurisdiction, each aspect plays a crucial role in determining the outcome of a claim. As the rideshare industry continues to evolve, staying informed about emerging technologies and changing regulations is essential for effectively handling these unique cases.

Ultra Law’s expertise in personal injury law, combined with their deep understanding of the rideshare industry, positions them uniquely to handle the complexities of Uber accident claims. Their team stays abreast of the latest developments in this rapidly evolving field, ensuring that clients receive the most up-to-date and effective legal representation.

If you’ve been involved in an Uber accident, don’t navigate these complex waters alone. Contact Ultra Law today for a free consultation. Our experienced team will guide you through every step of the process, fighting tirelessly to ensure you receive the compensation you deserve.