In 2022, Visa and Mastercard faced a $5.54 billion class action settlement, one of the largest in U.S. history. This staggering figure caught my attention while researching credit card fees for my small business. I realized how these lawsuits impact millions of merchants and consumers, often without our full awareness.

Visa class action lawsuits have a complex history rooted in the evolving financial landscape. These legal battles emerged from the intersection of technological advancements, market disruptions, and globalization. Understanding their origins provides crucial context for grasping their current significance and potential future developments.

The emergence of electronic payment systems in the 1970s laid the groundwork for future legal challenges. As these systems became more sophisticated, they introduced new complexities in fee structures and transaction processing. This technological evolution created opportunities for practices that would later be scrutinized in court.

Deregulation of the financial industry in the 1980s and 1990s opened the floodgates for innovation in the credit card sector. While this led to increased competition and new financial products, it also created an environment where questionable practices could flourish. The lack of stringent oversight during this period set the stage for many of the issues that would later become central to class action lawsuits against Visa.

According to a recent settlement announcement, Visa has agreed to reduce credit interchange rates for U.S. merchants, with more than 90% of affected merchants being small businesses. This development highlights the ongoing impact of these lawsuits on the financial landscape and the potential for significant changes in industry practices.

The rapid pace of technological change in the financial sector has been a key driver behind many Visa class action lawsuits. As new payment methods and financial technologies emerged, they created unforeseen challenges and opportunities that sometimes led to practices that were later challenged in court.

The introduction of EMV chip technology altered fraud liability, sparking legal debates. When this technology was rolled out in the United States, it shifted the responsibility for certain types of fraud from card issuers to merchants who hadn’t upgraded their systems. This change in liability led to heated discussions and legal challenges over who should bear the costs of fraud prevention.

The rise of contactless payments introduced new fee structures, leading to merchant dissatisfaction. As consumers embraced the convenience of tapping their cards or phones to make payments, some merchants found themselves facing higher fees for these transactions. This discrepancy became a point of contention in several lawsuits.

Development of tokenization for mobile payments raised questions about data ownership and privacy. As mobile payment systems became more prevalent, the use of tokenization to secure transactions introduced new complexities in how financial data was handled and protected. These issues have become increasingly relevant in legal discussions surrounding data privacy and security in financial transactions.

The introduction of EMV chip technology in the United States led to a “liability shift” in 2015. This shift meant that merchants who hadn’t upgraded to EMV-capable terminals could be held liable for certain types of fraud. This change sparked debates and legal challenges over who should bear the costs of fraud prevention and who benefits most from these technological advancements.

While not directly involved in most Visa transactions, blockchain technology has indirectly influenced the credit card industry and, by extension, the landscape of class action lawsuits. The emergence of cryptocurrencies and blockchain-based financial systems has pushed traditional payment processors to adapt, sometimes in ways that have led to legal challenges.

Blockchain’s promise of lower transaction fees highlighted Visa’s fee structure. As blockchain-based payment systems touted their ability to process transactions with minimal fees, it drew attention to the higher fees charged by traditional credit card networks. This comparison has fueled discussions about the fairness and necessity of existing fee structures.

Smart contracts on blockchain platforms influenced expectations for transparency in financial transactions. The concept of self-executing contracts with terms directly written into code has raised questions about the level of transparency that should be expected in all financial transactions, including those processed by Visa.

Decentralized finance (DeFi) concepts challenged traditional notions of financial intermediaries. As DeFi platforms demonstrated the possibility of conducting financial transactions without traditional intermediaries, it sparked debates about the role and value of established payment processors like Visa in the modern financial ecosystem.

Source: Verified Market Research

The widespread adoption of mobile payment solutions has dramatically altered how consumers interact with their finances. This shift has created new expectations for convenience, speed, and transparency in transactions, sometimes leading to friction between consumers, merchants, and credit card companies like Visa.

In-app purchases and digital wallets introduced new complexities in fee structures. As consumers increasingly made purchases within apps or using digital wallets, it created new scenarios for how transactions were processed and fees were applied. These new payment methods have sometimes led to disputes over fee transparency and fairness.

Peer-to-peer payment apps set new standards for transaction speed and cost. The rise of apps allowing users to send money directly to each other with minimal fees has put pressure on traditional payment processors to justify their higher fee structures and processing times.

Integration of loyalty programs with mobile payments raised questions about data usage and consumer privacy. As payment systems became more intertwined with loyalty programs and data collection, it sparked debates about how consumer information was being used and protected.

As international commerce became increasingly common, it introduced a new layer of complexity to credit card transactions. The challenges of operating across different regulatory environments and currency systems have been a fertile ground for legal disputes, often culminating in class action lawsuits against Visa and other major payment processors.

Variations in interchange fees across countries led to accusations of unfair practices. Merchants operating in multiple countries found themselves dealing with significantly different fee structures, leading to questions about the justification for these variations and whether they constituted discriminatory practices.

Currency conversion fees became a major point of contention in cross-border transactions. Consumers and merchants alike have challenged the transparency and fairness of fees applied when transactions involve currency conversion, leading to several high-profile lawsuits.

Differences in chargeback rules between countries created confusion and potential for abuse. The lack of standardization in how chargebacks are handled across borders has led to disputes over liability and fairness in international transactions.

| Aspect | Domestic Transactions | Cross-Border Transactions |

|---|---|---|

| Interchange Fees | Relatively standardized | Vary significantly by country |

| Currency Conversion | Not applicable | Additional fees often apply |

| Chargeback Rules | Consistent within country | Vary based on issuing country |

| Regulatory Oversight | Single jurisdiction | Multiple jurisdictions involved |

The patchwork of international financial regulations has sometimes created opportunities for practices that, while technically legal in some jurisdictions, have been challenged as unfair or deceptive in others. These regulatory disparities have been at the heart of several class action lawsuits against Visa.

Some companies have used subsidiaries in countries with lax regulations to process certain transactions, potentially circumventing stricter rules in other jurisdictions. This practice has led to accusations of regulatory arbitrage and has been a focus of several legal challenges.

The implementation of different fee structures for domestic vs. international transactions has also been a point of contention. Merchants and consumers have questioned the justification for these differences, especially in cases where the actual processing costs may not differ significantly.

Variations in disclosure requirements across jurisdictions have led to transparency issues. What might be considered adequate disclosure in one country could be deemed insufficient in another, creating challenges for both Visa and its customers operating across borders.

Source: Medium

Currency exchange controversies have been a significant driver of class action lawsuits against Visa. The complexities of international transactions often involve fees and exchange rates that aren’t immediately apparent to consumers or merchants, leading to accusations of hidden charges and lack of transparency.

Dynamic Currency Conversion (DCC) practices and associated fees have been particularly controversial. While DCC offers consumers the option to pay in their home currency, it often comes with unfavorable exchange rates and additional fees that may not be clearly disclosed at the point of sale.

The timing of exchange rate applications in multi-day transactions has also been a source of disputes. Fluctuations in exchange rates between the time a transaction is initiated and when it’s settled can lead to unexpected costs for consumers and merchants alike.

Discrepancies between interbank rates and rates applied to card transactions have raised questions about fairness and transparency. Consumers and merchants have challenged the markup applied to exchange rates in card transactions, arguing that these markups are often excessive and poorly disclosed.

A common issue in cross-border transactions is Dynamic Currency Conversion (DCC). For instance, a U.S. traveler in Europe might be offered the option to pay in USD rather than Euros. While this seems convenient, it often involves hidden markup fees and less favorable exchange rates, leading to higher overall costs for the consumer. Such practices have been the subject of several class action lawsuits against credit card companies.

Visa class action lawsuits have unique structural elements that set them apart from other legal proceedings. Understanding these distinctions is crucial for grasping the full impact and implications of these cases.

Multi-district litigation (MDL) is often used to consolidate similar cases against Visa. This approach allows for more efficient handling of complex cases that span multiple jurisdictions, but it also introduces its own set of challenges in terms of case management and settlement negotiations.

The certification process for determining class status and representation is a critical phase in these lawsuits. This process involves demonstrating that a group of plaintiffs share common grievances and that a class action is the most appropriate way to address these issues.

In a recent class action lawsuit, it was estimated that between 175 and 215 million customers may have been affected by alleged excessive ATM fees. This staggering number underscores the widespread impact of the practices challenged in these lawsuits and the potential for significant financial implications.

In many Visa class action lawsuits, it’s not individual consumers but groups of merchants who drive the legal action. This dynamic creates a different set of challenges and strategies compared to consumer-driven class actions.

The formation of merchant associations to pool resources for legal action has become a common strategy. These coalitions allow smaller businesses to collectively challenge practices that might be too costly or complex for individual merchants to tackle alone.

The use of expert witnesses to demonstrate industry-wide impact of Visa’s practices is crucial in these cases. These experts often provide detailed analyses of fee structures, market dynamics, and the economic impact of challenged practices on various sectors of the economy.

Maintaining cohesion among diverse merchant plaintiffs can be challenging. Different types of businesses may have varying priorities and perspectives on the issues at hand, requiring careful management to present a unified case.

Different industries often form alliances to address specific grievances against Visa’s practices. These sector-specific approaches can lead to more targeted legal strategies and potentially more impactful outcomes.

The hospitality industry, for instance, has focused on issues related to resort fees and surcharges. Hotels and resorts have challenged how these fees are processed and the associated costs, arguing that current practices unfairly impact their businesses.

The e-commerce sector has raised challenges related to card-not-present transaction fees. As online shopping has grown, so too have concerns about the higher fees associated with these transactions, leading to legal challenges from online retailers.

The grocery and retail industry has expressed concerns about interchange fees on low-margin items. These businesses argue that the flat percentage-based fees disproportionately impact their profitability on essential, low-margin products.

Source: YouTube

Small businesses face unique challenges when participating in class action lawsuits against financial giants like Visa. Their stories often resonate with the public and can influence both legal strategies and public opinion.

The use of representative plaintiffs to highlight small business struggles has been an effective strategy in many cases. These plaintiffs often provide compelling narratives that illustrate the real-world impact of challenged practices on local economies and communities.

Quantifying damages for small merchants with limited resources can be particularly challenging. Many small businesses lack the sophisticated financial tracking systems of larger corporations, making it difficult to precisely calculate the impact of disputed practices.

Strategies for amplifying small business voices in large-scale litigation have become increasingly important. Legal teams often work to ensure that the concerns of smaller merchants aren’t overshadowed by larger players in the class.

Many class action lawsuits target not just Visa, but multiple card networks and financial institutions simultaneously. This complexity introduces unique challenges and dynamics to the legal proceedings.

Coordination of defense strategies among multiple corporate defendants can be a complex process. While these companies may share some common interests, they may also have divergent priorities or approaches to addressing the allegations.

Attributing specific practices or damages to individual defendants presents significant challenges in these cases. The interconnected nature of the payment processing ecosystem can make it difficult to isolate the actions and responsibilities of any single entity.

The potential for conflicting interests among co-defendants adds another layer of complexity to these cases. What might be an acceptable settlement or strategy for one defendant could be problematic for another, creating tensions within the defense.

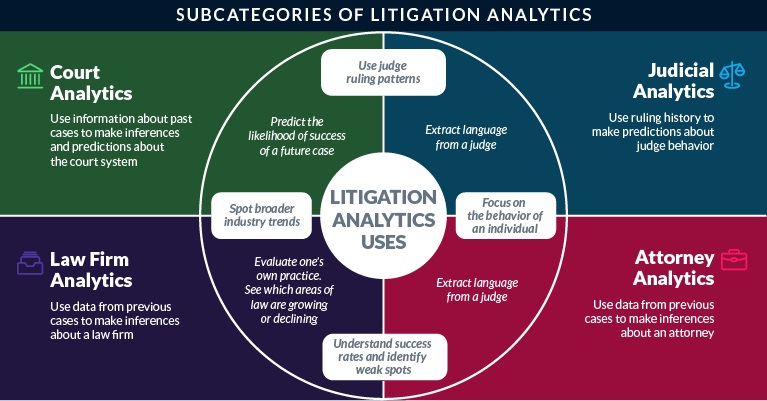

Source: Court Street Law

In cases involving multiple defendants, companies like Visa and Mastercard may employ different strategies, potentially affecting the outcome of the lawsuit. Understanding these tactics is crucial for plaintiffs and the court.

The use of separate expert witnesses by different defendants to challenge plaintiff claims is a common strategy. Each defendant may bring in specialists to address specific aspects of the case relevant to their role in the payment ecosystem.

Strategic timing of settlement offers by individual defendants can significantly impact the course of the litigation. Early settlements by some parties can alter the dynamics of the case for remaining defendants.

The potential for cross-claims among defendants adds another layer of complexity to these cases. Defendants may seek to shift liability or recover damages from each other, further complicating the legal proceedings.

The involvement of issuing banks as co-defendants in Visa class action lawsuits adds another layer of complexity to these cases. Banks play a unique role in the credit card ecosystem, and their inclusion in lawsuits can significantly impact the legal strategies and potential outcomes.

The distinction between bank-issued cards and network-branded cards in a legal context is crucial. This differentiation can affect how liability is assigned and how damages are calculated in these cases.

Banks play a significant role in setting certain fees and terms challenged in lawsuits. Understanding this role is essential for accurately addressing the issues at the heart of many class action cases.

Potential conflicts between banks and card networks in joint defense strategies can arise. While these entities often work closely together in the payment ecosystem, their interests

Potential conflicts between banks and card networks in joint defense strategies can arise. While these entities often work closely together in the payment ecosystem, their interests may not always align in the context of legal proceedings.

In a hypothetical class action lawsuit, a group of small businesses might sue Visa, Mastercard, and several large issuing banks over interchange fees. While Visa and Mastercard might argue that they merely set maximum rates, the issuing banks could be accused of consistently charging those maximum rates without justification. This scenario illustrates the complex interplay between different entities in the credit card ecosystem and the challenges in assigning responsibility for alleged unfair practices.

The process of reaching and implementing settlements in Visa class action lawsuits is intricate and often fraught with challenges. Understanding these dynamics is crucial for all parties involved, from plaintiffs to defendants to the courts overseeing the cases.

The negotiation of injunctive relief vs. monetary compensation in settlements is a key aspect of these cases. While monetary settlements often grab headlines, changes in business practices mandated by injunctive relief can have far-reaching and long-lasting impacts on the industry.

Estimating the true value of non-monetary settlement terms presents significant challenges. Changes in business practices or fee structures may have substantial long-term value, but quantifying this value for settlement purposes can be complex and contentious.

In a recent settlement, Visa agreed to cap reduced credit interchange rates for five years, providing an unprecedented level of cost certainty for merchants. This type of agreement demonstrates the potential for class action lawsuits to drive significant changes in industry practices.

External entities play a crucial role in managing the complex settlement process an Fund distribution in Visa class action lawsuits involves specialized software for claims processing and allocation. These systems streamline the handling of potentially millions of individual claims, ensuring efficiency and accuracy in the distribution process.

Fraud detection algorithms play a vital role in claims review. As with any large-scale financial distribution, the potential for fraudulent claims exists. Advanced algorithms help identify suspicious patterns or anomalies in claim submissions.

Locating and notifying all potential class members presents significant hurdles. Given the vast number of individuals who may be eligible for compensation, ensuring comprehensive outreach is a complex undertaking.

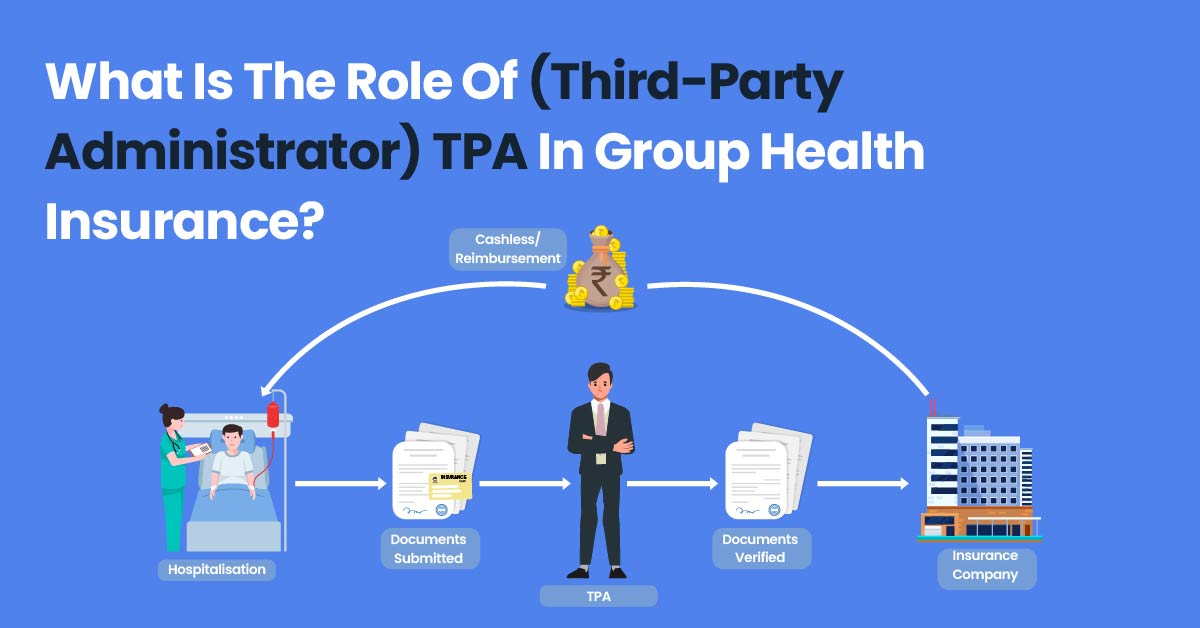

Source: Plancover

Innovative technologies are reshaping the settlement landscape in Visa class action lawsuits. These advancements promise to increase efficiency and transparency in the settlement process.

Smart contracts offer potential for automated distribution of settlement funds. By encoding settlement terms directly into blockchain-based contracts, funds could be disbursed automatically when specific conditions are met.

Machine learning algorithms are being explored for identifying potentially fraudulent claims. These systems can analyze vast datasets to spot patterns indicative of fraud, improving the integrity of the settlement process.

Blockchain-based systems for transparent tracking of fund distribution are gaining traction. The immutable nature of blockchain records could provide unprecedented transparency in how settlement funds are allocated and disbursed.

Balancing accessibility and security in settlement implementation is a delicate act. Making the process accessible to legitimate claimants while preventing fraudulent claims requires sophisticated systems and vigilant oversight.

Multi-factor authentication systems for claim submission enhance security. By requiring multiple forms of verification, these systems reduce the risk of fraudulent claims without creating undue barriers for legitimate claimants.

Risk scoring algorithms flag potentially fraudulent claims for further review. These systems assess various factors to identify claims that may require additional scrutiny.

Tiered verification processes based on claim amount help streamline the process. Smaller claims might require less rigorous verification, while larger claims undergo more thorough checks.

| Aspect | Traditional Methods | Innovative Technologies |

|---|---|---|

| Claim Submission | Paper forms, manual entry | Online portals, mobile apps |

| Fraud Detection | Manual review, basic checks | AI-powered risk scoring |

| Fund Distribution | Paper checks, bank transfers | Smart contracts, digital wallets |

| Transparency | Periodic reports | Real-time blockchain tracking |

| Claimant Verification | Document submission | Multi-factor digital authentication |

The outcomes of Visa class action lawsuits can have far-reaching effects on the financial industry and consumer behavior. Understanding these long-term impacts is crucial for assessing the true significance of these legal battles.

Analysis of market share shifts following major settlements reveals interesting patterns. These shifts can indicate changes in merchant preferences or consumer behavior in response to the outcomes of high-profile lawsuits.

Changes in consumer credit card usage patterns post-settlement are worth noting. Increased awareness of fee structures or changes in card policies resulting from settlements may influence how consumers choose and use credit cards.

The impact on interchange fee structures across the industry can be substantial. Settlements often lead to adjustments in fee structures, not just for the defendant company but potentially across the entire payment processing sector.

![]()

Source: Market.us

Following major settlements, the credit card industry often evolves, potentially leading to new business models or practices. These adaptations can reshape the competitive landscape and influence future legal challenges.

Development of new fee structures to offset settlement costs is a common response. Companies may seek to recoup losses through alternative revenue streams or by restructuring existing fee models.

Increased investment in compliance and risk management systems often follows high-profile settlements. Companies aim to prevent future legal challenges by enhancing their ability to detect and address potential issues proactively.

Shifts in marketing strategies to emphasize transparency and fairness are frequently observed post-settlement. Companies may focus on rebuilding trust and improving their public image through more transparent communication about fees and practices.

High-profile settlements can significantly affect consumer trust in credit card companies and influence payment method preferences. This shift in consumer sentiment can have lasting impacts on the industry.

Analysis of brand perception metrics before and after major settlements provides valuable insights. These metrics can reveal how legal outcomes influence public opinion and trust in financial institutions.

Changes in consumer adoption rates of alternative payment methods may accelerate following high-profile lawsuits. Consumers might explore options like digital wallets or peer-to-peer payment systems in response to concerns about traditional credit card practices.

The impact on customer retention and acquisition costs for credit card companies can be substantial. Rebuilding trust and attracting new customers in the wake of negative publicity from lawsuits often requires significant investment.

As technology and financial practices continue to evolve, the landscape of class action lawsuits against credit card companies is likely to transform. Anticipating these changes is crucial for all stakeholders in the financial ecosystem.

Potential impact of proposed legislative changes on class action procedures could significantly alter how these cases are pursued and resolved. Reforms aimed at streamlining the class action process or changing the standards for certification could have far-reaching effects.

Emerging technologies that could become focal points of future lawsuits are worth watching. As financial services become increasingly digital and data-driven, new areas of legal contention may arise around issues like AI-driven decision making or blockchain-based financial products.

With increasing focus on data privacy and ownership, a new generation of class action lawsuits against financial institutions like Visa may emerge. These cases could center on how consumer data is collected, used, and protected in financial transactions.

The implications of GDPR and similar regulations on credit card data practices are significant. As data protection laws become more stringent globally, credit card companies may face new legal challenges related to their data handling practices.

Potential legal challenges related to data monetization by financial institutions are on the horizon. As companies seek new revenue streams from consumer data, questions about consent and fair compensation for data use may arise.

Emerging concepts of consumer data ownership and control in financial contexts are shaping the legal landscape. The idea that consumers should have more control over their financial data could lead to new types of legal claims against credit card companies.

Source: Consumer Financial Protection Bureau

As biometric payment systems become more prevalent, they introduce new legal considerations and potential areas for class action lawsuits. The unique nature of biometric data adds complexity to issues of privacy, security, and consent.

Storage and encryption standards for biometric payment data are likely to be scrutinized. The sensitive nature of biometric information raises the stakes for data protection, potentially leading to stricter legal standards and more severe penalties for breaches.

Consent mechanisms for biometric data collection in financial transactions may become a contentious issue. Ensuring that consumers fully understand and agree to the collection and use of their biometric data presents unique challenges in the fast-paced world of digital payments.

Liability issues in cases of biometric data breaches or misuse could lead to significant legal challenges. The permanent and unchangeable nature of biometric data makes breaches particularly serious, potentially leading to new legal frameworks for liability and compensation.

The trend towards open banking introduces new players into the financial ecosystem, potentially creating new areas of legal contention and class action potential. Understanding the implications of third-party access to financial data is crucial for anticipating future legal challenges.

API security standards for third-party financial service providers are likely to come under increased scrutiny. As more third parties gain access to sensitive financial data, ensuring the security of these connections becomes paramount.

Liability allocation in cases of data breaches involving multiple parties presents complex legal questions. Determining responsibility when a breach occurs across interconnected systems involving multiple entities could lead to new types of class action lawsuits.

Consumer consent mechanisms for data sharing in open banking systems may become a focal point for legal challenges. Ensuring that consumers understand and meaningfully consent to how their data is shared and used in these complex ecosystems presents significant challenges.

Source: Teradata

A growing trend towards international cooperation in regulating financial institutions is emerging. This alignment could significantly impact the nature and scope of future class action lawsuits against companies like Visa.

Development of international standards for interchange fees is gaining momentum. As global commerce becomes more interconnected, pressure is mounting for more consistent fee structures across borders.

Harmonization efforts in cross-border transaction regulations are underway. These efforts aim to reduce discrepancies in how transactions are handled and regulated across different jurisdictions.

The impact of trade agreements on financial service regulations cannot be overlooked. As countries negotiate trade deals, financial services often play a key role, potentially leading to more standardized practices and regulations globally.

As financial transactions increasingly span borders, class action lawsuits that encompass multiple countries and legal systems may become more prevalent. These cross-border cases present unique complexities for all parties involved.

Mechanisms for coordinating legal actions across multiple jurisdictions are evolving. Courts and legal systems are grappling with how to handle cases that span different countries with varying legal frameworks.

Challenges in applying different legal standards to global financial practices are significant. What may be considered a violation in one country might be standard practice in another, creating complex legal questions in multinational cases.

The potential for forum shopping in international class action lawsuits is a concern. Plaintiffs may seek to file cases in jurisdictions perceived as more favorable, leading to debates about the appropriate venue for these global cases.

The harmonization of international financial regulations could affect the frequency and nature of class action lawsuits against companies like Visa. This alignment may close certain loopholes while potentially opening new areas for legal challenges.

Standardized disclosure requirements could impact transparency-related lawsuits. As global standards for financial disclosures become more uniform, it may change the landscape for legal challenges based on inadequate or misleading information.

Unified data protection standards could reshape privacy-related class actions. Global alignment on data protection practices may lead to more consistent legal approaches to privacy violations across different jurisdictions.

The potential for new types of class actions based on globally recognized consumer rights is emerging. As international consensus grows around certain consumer protections, it could give rise to new categories of legal claims against financial institutions.

Technological advancements are reshaping the landscape of class action lawsuits against Visa, from evidence gathering to case management. These innovative tools are transforming legal proceedings in significant ways.

E-discovery platforms are now crucial in large-scale financial litigation. These tools allow legal teams to sift through vast amounts of digital evidence efficiently, uncovering key information that might otherwise be overlooked.

Data visualization tools are increasingly used to present complex financial information in court. These tools can help judges and juries grasp intricate financial concepts and data patterns more easily, potentially influencing case outcomes.

Large-scale data analysis is becoming increasingly vital in identifying patterns of behavior and potential violations in Visa’s practices. This technology enables more comprehensive and precise legal arguments.

Predictive analytics are being applied to forecast potential damages in these cases. By analyzing historical data and market trends, legal teams can develop more accurate estimates of the financial impact of challenged practices.

Pattern recognition algorithms are helping identify systemic issues in fee structures. These tools can uncover hidden patterns or anomalies in vast datasets of transaction records, potentially revealing previously undetected problematic practices.

Natural language processing is being implemented to analyze internal communications. This technology can sift through emails, memos, and other corporate documents to identify relevant information or potential evidence of wrongdoing.

Source: LexisNexis

Artificial intelligence, particularly machine learning, is revolutionizing the document review process in Visa class action lawsuits. These tools can sift through vast amounts of financial data and documents, enhancing the efficiency and effectiveness of legal discovery.

AI models are being trained on financial jargon and industry-specific terminology. This specialized training allows these systems to understand and categorize complex financial documents more accurately.

Supervised learning algorithms are being used to categorize and prioritize documents. By learning from human-classified examples, these systems can quickly sort through millions of documents, identifying those most relevant to the case.

Anomaly detection systems are being implemented to flag unusual transaction patterns. These tools can identify outliers or unexpected trends in financial data, potentially uncovering evidence of improper practices.

Blockchain technology has the potential to provide tamper-proof evidence of transaction histories in class action lawsuits against Visa. This could significantly impact how evidence is presented and verified in court.

Integration of blockchain-based transaction logs with traditional financial records is being explored. This combination could provide a more comprehensive and verifiable record of financial transactions.

Standards for admitting blockchain evidence in court are being developed. As this technology becomes more prevalent, legal systems are grappling with how to properly authenticate and admit blockchain-based evidence.

Reconciling blockchain records with legacy financial systems presents challenges. Bridging the gap between new blockchain-based systems and traditional financial record-keeping is a complex but necessary task for leveraging this technology in legal proceedings.

Digital platforms are increasingly facilitating communication, claims processing, and information dissemination in large-scale lawsuits against Visa. These tools are making it easier for class members to stay informed and engaged throughout the legal process.

Secure portals for class members to submit claims and documentation

Secure portals for class members to submit claims and documentation are becoming standard. These platforms streamline the claims process, reducing paperwork and improving accuracy in claim submissions.

Chatbots are being implemented to answer frequently asked questions about lawsuits. These AI-powered assistants can provide instant responses to common queries, reducing the workload on human support staff.

Data analytics are being used to track class member engagement and optimize communication strategies. By analyzing how class members interact with various communications, legal teams can refine their outreach efforts for maximum effectiveness.

Social media platforms are being leveraged in innovative ways to gather information and connect potential class members in Visa lawsuits. This approach can significantly expand the reach and impact of class action efforts.

Social listening tools are being used to identify potential class members. By monitoring social media discussions related to the issues at hand, legal teams can identify and reach out to individuals who may be eligible to join the class.

Secure, purpose-built social platforms for case-related discussions are being developed. These platforms provide a controlled environment for class members to share information and experiences relevant to the case.

Verification processes for user-submitted information on social media are being implemented. These measures help ensure the accuracy and reliability of information gathered through social channels.

Specialized mobile applications are being developed to keep class members informed and engaged throughout the legal process of Visa class action lawsuits. These apps provide a more immediate and interactive way for individuals to participate in the case.

Push notifications for important case updates ensure that class members stay informed in real-time. This immediate communication helps maintain engagement and ensures that important deadlines or developments are not missed.

In-app document submission and verification features streamline the process for class members. These tools make it easier for individuals to provide necessary information or documentation directly through their mobile devices.

Secure messaging systems for direct communication with legal teams enhance accessibility. These features allow class members to ask questions or provide additional information easily and securely.

The repercussions of class action lawsuits against Visa extend far beyond the immediate parties involved, influencing international financial systems and regulatory frameworks. Understanding these global impacts is crucial for grasping the full significance of these legal battles.

Analysis of how U.S. lawsuit outcomes influence global Visa policies reveals interesting patterns. Decisions made in response to U.S. legal challenges often have ripple effects on Visa’s practices worldwide.

Examination of the ripple effects on international financial regulations shows the far-reaching impact of these cases. Regulatory bodies in other countries often take cues from the outcomes of U.S. lawsuits, potentially leading to similar regulatory changes globally.

The outcomes of U.S.-based class actions against Visa often influence financial regulations in other countries. This cross-border impact reshapes the global landscape of payment processing and consumer protection.

Adoption of similar fee disclosure requirements in non-U.S. jurisdictions post-settlement is becoming more common. As transparency becomes a key issue in U.S. lawsuits, other countries often follow suit in demanding clearer fee disclosures.

Proactive policy changes by international regulators in anticipation of similar lawsuits are increasingly observed. Regulators worldwide are learning from U.S. cases and preemptively addressing potential issues in their own jurisdictions.

Development of global best practices for interchange fee structures based on lawsuit outcomes is an emerging trend. The resolutions of U.S. cases often serve as a blueprint for fee structure reforms internationally.

Regulatory bodies across different nations are increasingly collaborating in response to issues highlighted by class action lawsuits. This international cooperation aims to create a more unified approach to financial oversight.

Multinational task forces are being formed to address cross-border payment issues. These collaborative efforts bring together regulators from various countries to tackle complex challenges in the global financial system.

Information-sharing protocols between national financial regulators are being established. These agreements facilitate the exchange of crucial data and insights, enabling more effective oversight of multinational financial entities.

Joint investigation frameworks for multinational financial entities are being developed. These structures allow regulators from different countries to coordinate their efforts when investigating large-scale financial irregularities.

High-profile lawsuits against Visa have accelerated the movement towards more unified global standards for consumer protection in financial services. This trend is reshaping how consumers interact with financial institutions worldwide.

Standardized dispute resolution processes across borders are being implemented. These unified procedures aim to provide consistent and fair treatment for consumers regardless of where transactions occur.

Universal definitions for key financial terms and practices are being established. This common language helps reduce confusion and ensures consistent interpretation of financial agreements across different jurisdictions.

Global consumer education initiatives on payment processing rights are being launched. These programs aim to empower consumers worldwide with knowledge about their rights and protections in financial transactions.

Large-scale settlements in Visa class actions can have broad economic impacts on international trade and financial markets. These effects ripple through the global economy, influencing everything from currency values to market competition.

Settlement-induced shifts in global payment processing market share are being closely monitored. The outcomes of these lawsuits can alter the competitive landscape, potentially opening doors for new players or alternative payment methods.

Changes in international investment patterns in fintech sectors often follow major settlements. Investors may reassess their strategies based on the new regulatory environment shaped by lawsuit outcomes.

Long-term impacts on global e-commerce growth rates are being assessed. The resolution of these lawsuits can influence the cost and ease of online transactions, potentially affecting the trajectory of e-commerce expansion worldwide.

Significant settlements in Visa class actions can potentially affect currency exchange rates and international money flows. This volatility has implications for global trade and investment strategies.

Short-term currency fluctuations following major settlement announcements are being modeled. These models help predict and prepare for potential market reactions to lawsuit outcomes.

Changes in forex hedging strategies by multinational corporations are being observed. Companies are adjusting their approaches to managing currency risk in light of the evolving landscape of payment processing regulations.

Central bank interventions in response to settlement-related market movements are being examined. These interventions highlight the broader economic implications of large-scale financial settlements.

The outcomes of class action lawsuits influence the competitive landscape of global payment processing. These shifts can open doors for new players or alternative payment methods, reshaping the industry’s future.

Market entry patterns for fintech startups post-major settlements are being analyzed. The resolution of these lawsuits often creates opportunities for innovative companies to enter the market with new solutions.

Changes in merchant adoption rates for alternative payment systems are being tracked. As traditional payment processors face legal challenges, merchants may become more open to exploring new payment technologies.

The long-term viability of traditional card networks in evolving financial ecosystems is being reassessed. The outcomes of these lawsuits may accelerate the transition to new payment technologies and business models.

Behind the legal jargon and financial figures of Visa class action lawsuits are real people with compelling stories. These personal narratives provide a more empathetic perspective on the legal proceedings and their real-world impact.

Case study methodologies for capturing diverse lawsuit experiences are being developed. These approaches aim to present a comprehensive picture of how different individuals and businesses are affected by the practices in question.

Long-term financial and emotional impacts on lawsuit participants are being analyzed. These studies help illuminate the full scope of consequences beyond just the immediate financial settlements.

Small business owners often bear the brunt of practices targeted in class action lawsuits against Visa. Their stories illuminate the real-world consequences of complex financial policies and the importance of legal recourse.

Fee impacts on small business profit margins are being quantitatively analyzed. These studies reveal how seemingly small changes in transaction fees can significantly affect the bottom line for small enterprises.

Changes in small business banking behaviors post-lawsuit are being examined. These shifts can indicate how legal outcomes influence the financial strategies of small business owners.

Long-term effects on small business growth and survival rates are being assessed. The outcomes of these lawsuits can have lasting impacts on the viability and success of small enterprises.

Different industries face unique challenges related to credit card processing fees and practices. Highlighting these sector-specific impacts provides a nuanced understanding of how Visa’s policies affect various parts of the economy.

Comparative analyses of fee structures across different business sectors are being conducted. These studies reveal how certain industries may be disproportionately affected by specific fee policies.

Industry-specific compliance costs related to payment processing are being examined. These assessments show how regulatory changes resulting from lawsuits can impact different sectors in varying ways.

Technological adoption rates for payment systems across sectors are being evaluated. These studies reveal how different industries adapt to new payment technologies in response to legal and market changes.

Some individual merchants have become vocal advocates and key players in initiating or supporting class action lawsuits against Visa. Their personal journeys from business owners to legal activists offer inspiring tales of perseverance and justice-seeking.

Common traits among merchant-activists in financial lawsuits are being identified. Understanding these characteristics helps illuminate what drives individuals to take on leadership roles in these complex legal battles.

The role of social media in amplifying individual merchant voices is being studied. These platforms have become crucial tools for merchants to share their experiences and rally support for their causes.

Long-term career impacts on merchants who become lawsuit figureheads are being assessed. These studies reveal how taking a stand in high-profile legal cases can affect an individual’s professional trajectory.

Consumers affected by the practices addressed in Visa class action lawsuits have varied experiences and viewpoints. Their stories provide insight into the personal impact of seemingly abstract financial policies.

Consumer impact measurement tools for lawsuit-related issues are being developed. These instruments aim to quantify the real-world effects of disputed practices on individual consumers.

Changes in consumer financial literacy following high-profile cases are being analyzed. These studies reveal how legal proceedings can serve as educational opportunities, increasing public awareness of financial practices.

Shifts in consumer payment preferences post-lawsuit are being examined. These changes can indicate how legal outcomes influence consumer trust and behavior in the financial marketplace.

Many consumers have discovered unexpected charges and fees, leading to personal financial hardships. These individual stories illustrate the real-world consequences that spark legal action.

Cumulative fee impacts on average household budgets are being quantitatively analyzed. These studies reveal how seemingly small charges can add up to significant financial burdens over time.

Long-term credit score effects related to disputed charges are being assessed. These investigations show how contested fees can have lasting impacts on consumers’ financial health.

Changes in consumer saving and spending patterns post-fee discovery are being studied. These shifts can indicate how awareness of hidden fees influences overall financial behavior.

Class members often face complex and lengthy processes when claiming and receiving settlement funds. Their experiences highlight the challenges of making legal remedies accessible to the average person.

Claim submission rates and common barriers to completion are being analyzed. These studies help identify obstacles in the claims process and inform strategies to improve accessibility.

The effectiveness of different claim notification methods is being examined. These assessments guide efforts to ensure all eligible class members are aware of their rights and opportunities for compensation.

Long-term satisfaction rates among settlement recipients are being evaluated. These studies provide insights into the overall effectiveness of class action resolutions from the perspective of those directly affected.