I’ve been keeping a close eye on the CarShield class action lawsuit, and let me tell you, it’s shaking up the extended warranty industry. As someone who’s dealt with unclear coverage terms and pushy sales tactics, I’m not surprised this case has gained so much attention. It’s not just about one company – it’s a wake-up call for the entire industry.

Let’s dive into what’s really going on here. CarShield, a vehicle service contract provider, has found itself in hot water over its business practices and marketing strategies. Consumers have raised red flags about contract clarity, coverage limitations, and aggressive sales tactics. These complaints didn’t just disappear into the void – they snowballed into legal action that’s put CarShield under the microscope.

Now, you might be wondering, “What’s the big deal? Aren’t all warranties kind of confusing?” Well, yes and no. While it’s true that many extended warranty contracts can be complex, the allegations against CarShield suggest something more troubling. The Federal Trade Commission (FTC) reported that CarShield earned commissions of about $600 million between September 2019 and November 2022 from selling vehicle service contracts. That’s a lot of money changing hands, and it raises questions about whether consumers are getting what they’re promised.

Source: ftc.gov

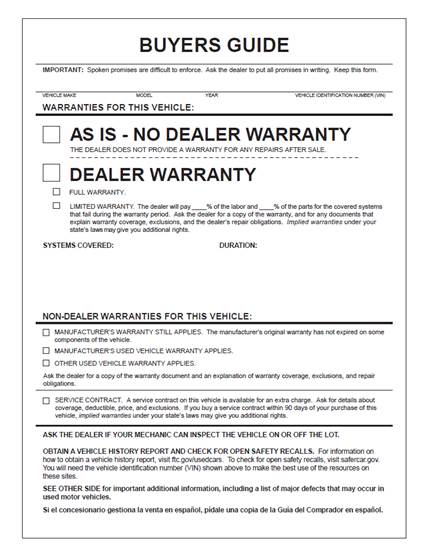

CarShield’s extended warranty offerings are supposed to give vehicle owners peace of mind. But here’s the kicker – the fine print often reveals limitations and exclusions that can leave you feeling like you’ve been taken for a ride. I’ve heard from folks who thought they were fully covered, only to find out their claim was denied due to some obscure clause.

Take John, for example. He bought a “Gold” level plan for his 5-year-old sedan, thinking he was set. When his alternator failed, he was in for a nasty surprise. CarShield denied the claim, citing a “wear and tear” exclusion. John was livid – the salesperson had assured him of comprehensive coverage, but the reality was far different.

This brings us to a crucial point: contract complexity. CarShield’s contracts are often filled with legal jargon that would make even a lawyer’s head spin. It’s not just about using big words – it’s about creating a document that’s so dense and convoluted that the average person has no hope of fully understanding what they’re signing up for.

Let’s break it down:

- Wear and tear exclusions can be interpreted so broadly that almost any repair could potentially be denied.

- Some plans require pre-authorization for repairs, which can leave you stranded while waiting for approval.

- High deductibles and coverage caps might mean you’re still shelling out significant cash even for “covered” repairs.

It’s a minefield out there, and CarShield’s contracts seem designed to keep you guessing.

But it’s not just about the contracts themselves. The way CarShield markets its products has come under fire too. They’ve spent millions on advertising, including those ubiquitous TV commercials featuring rapper Ice-T. Now, I love Ice-T as much as the next person, but should we really be basing our financial decisions on celebrity endorsements?

The FTC doesn’t think so. They reported that CarShield’s telemarketers used scripted statements claiming “there is just a $100 deductible for any covered repair.” Spoiler alert: that wasn’t true for many consumers. It’s this kind of misleading marketing that’s at the heart of the class action lawsuit.

And don’t even get me started on the telemarketing. I’ve heard from people who’ve been bombarded with calls from CarShield, even after asking to be removed from their list. It’s not just annoying – it might actually be illegal. The Telephone Consumer Protection Act (TCPA) has strict rules about this kind of thing, and violations can result in hefty fines.

Sarah, a retired teacher I spoke with, told me she was getting up to five calls a day from CarShield telemarketers. Five calls a day! She finally filed a complaint with the FTC out of sheer frustration. It’s stories like Sarah’s that really drive home how these practices affect real people.

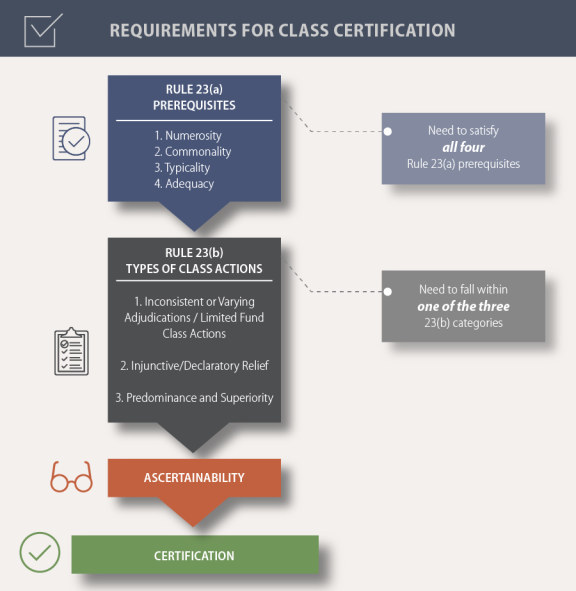

Now, let’s talk about the legal side of things. The class action lawsuit against CarShield is no small potatoes. We’re talking allegations of fraud, misrepresentation, and violations of consumer protection laws. It’s a complex case that could have far-reaching implications for how extended warranties are sold and regulated.

Source: everycrsreport.com

One of the key allegations is that CarShield engaged in a “bait and switch” tactic. Essentially, plaintiffs are saying the company advertised comprehensive coverage but delivered policies with significant limitations and exclusions. It’s like ordering a steak and getting served a hamburger – sure, it’s still beef, but it’s not what you were promised or paid for.

CarShield, of course, isn’t taking this lying down. They’re arguing that their contracts clearly state coverage limitations and that they comply with industry standards and regulations. They’re also trying to enforce arbitration clauses in their contracts, which would prevent class action lawsuits by requiring individual arbitration for disputes.

But here’s where it gets interesting – courts have sometimes found these arbitration clauses to be unenforceable. In a similar case involving a different extended warranty provider, the court ruled that the company’s arbitration clause was too one-sided and allowed the class action to proceed. It just goes to show that these legal battles are far from cut and dry.

The outcome of this lawsuit could have ripple effects throughout the entire extended warranty industry. We might see new regulations, stricter disclosure requirements, or even changes to how these products can be marketed. The FTC is already taking notice – they’ve cracked down on CarShield’s marketing practices, requiring clear disclosures about coverage limitations in their materials.

The FTC Business Blog reports on these new requirements, and it’s a sign that regulators are taking these issues seriously.

But what does all this mean for you, the consumer? Well, if you’re a CarShield customer or think you might have been affected by similar practices, there are steps you can take. First and foremost, keep detailed records of all your interactions with the company. That means contracts, correspondence, marketing materials – everything.

If you think you might be eligible to participate in the class action lawsuit, pay attention to any notices you receive. Class actions typically have strict deadlines for participation, and missing them could mean losing your right to compensation.

Of course, the class action isn’t your only option. You might consider alternative dispute resolution methods like mediation or arbitration. These can often be faster and less costly than litigation. Some folks even choose to pursue individual claims in small claims court. It’s all about weighing your options and deciding what’s best for your situation.

Now, I know this is a lot to take in. The world of extended warranties and class action lawsuits can be overwhelming. But here’s the bottom line: knowledge is power. By understanding your rights and the potential pitfalls of these contracts, you’re better equipped to make informed decisions and protect yourself from deceptive practices.

If you’re dealing with a CarShield dispute or any other extended warranty issue, don’t hesitate to seek help. At Ultra Law, we specialize in navigating these complex cases. Our team has experience handling complex settlement negotiations, which can be particularly beneficial in cases like the CarShield class action lawsuit.

Remember, you’re not alone in this. The CarShield lawsuit is shining a light on practices that have affected countless consumers. By staying informed and taking action when necessary, we can all play a part in pushing for fairer, more transparent practices in the extended warranty industry.

So, what’s next? Keep an eye on the news for updates on the CarShield case. Consider reviewing any extended warranty contracts you currently have, and don’t be afraid to ask questions or seek clarification on terms you don’t understand. And if you find yourself in a dispute with a warranty provider, know that there are resources and legal options available to help you fight for your rights.

The road to reform in the extended warranty industry might be long, but with increased awareness and action from consumers like you, we’re moving in the right direction. Stay vigilant, stay informed, and don’t let confusing contracts or aggressive sales tactics steer you wrong.

Learnings Recap

- The CarShield class action lawsuit highlights the importance of scrutinizing extended warranty contracts and marketing practices.

- Consumer education and advocacy play crucial roles in protecting individuals from potentially deceptive business practices.

- The outcome of this lawsuit could have far-reaching implications for the extended warranty industry and consumer protection regulations.

- Affected consumers have multiple options for seeking resolution, including participating in the class action or pursuing alternative dispute resolution methods.

- Documenting all interactions and maintaining thorough records is essential for building a strong case, regardless of the chosen resolution path.

Ultra Law’s Role in Addressing Consumer Concerns

At Ultra Law, we’re committed to helping consumers navigate the complex world of extended warranty disputes and class action lawsuits. Our team of experienced attorneys understands the intricacies of these cases and is dedicated to protecting your rights.

We offer personalized consultations to help you understand your options and determine the best course of action for your specific situation. Whether you’re considering joining the CarShield class action or exploring other avenues for resolution, we’re here to guide you every step of the way.

Our expertise in navigating complex legal settlements can be particularly valuable in cases like these, where the terms and potential outcomes can be confusing.

If you’ve been affected by the CarShield controversy or similar issues with other extended warranty providers, don’t hesitate to reach out. We’re here to help you understand your rights and fight for fair treatment.

Contact Ultra Law today to schedule a free case evaluation and take the first step towards resolving your extended warranty concerns. Let’s work together to ensure you get the coverage and compensation you deserve.

For more information on how we handle various types of legal claims, including class actions, visit our page on navigating complex legal scenarios in Las Vegas.