The 2019 Kraft Heinz $15.4 billion goodwill impairment sent shockwaves through the investment community. As someone who’s followed the food industry for years, I couldn’t help but wonder about the far-reaching implications of this case. The write-down caused a staggering 27.5% decline in Kraft Heinz’s share price, leaving investors reeling and sparking a series of legal actions that would reshape the company’s future.

The Securities Litigation: A Deep Dive

The securities class action lawsuit against Kraft Heinz settled for a whopping $450 million, making it the 41st largest federal securities class action settlement of all time. This wasn’t just a slap on the wrist; it was a seismic event in the world of corporate litigation.

The lawsuit alleged violations of Sections 10(b) and 20(a) of the Securities Exchange Act during a class period from May 4, 2017, to February 21, 2019. For investors caught in this tumultuous period, the settlement offered a glimmer of hope for recouping some of their losses.

| Key Aspects of Kraft Heinz Securities Litigation | |

|---|---|

| Alleged Violations | Sections 10(b) and 20(a) of Securities Exchange Act |

| Class Period | May 4, 2017 – February 21, 2019 |

| Settlement Amount | $450 million |

| Settlement Rank | 41st largest federal securities class action settlement |

But what led to such a massive settlement? The answer lies in the heart of the matter: accounting irregularities that shook investor confidence to its core.

Accounting Irregularities: The Heart of the Matter

Kraft Heinz was found to have improperly recognized cost savings from nearly 300 transactions with vendors. This wasn’t a small oversight; it inflated the company’s reported adjusted EBITDA by over $200 million between 2015 and 2018. As someone who’s pored over countless financial statements, I can tell you this is the kind of discrepancy that keeps auditors up at night.

Source: ResearchGate

The implications of these accounting irregularities were far-reaching. They didn’t just affect the numbers on a balance sheet; they eroded trust in Kraft Heinz’s financial reporting and raised serious questions about the company’s internal controls.

Goodwill Impairment and Its Implications

The $15.4 billion goodwill impairment was more than just a big number; it was a stark admission that Kraft Heinz had overvalued its assets. This massive write-down sent ripples through the entire food industry, prompting investors to scrutinize other companies’ valuations more closely.

Source: YouTube

The video above provides a detailed explanation of goodwill impairment and its impact on financial statements. It’s a complex topic, but understanding it is crucial for grasping the full scope of the Kraft Heinz case.

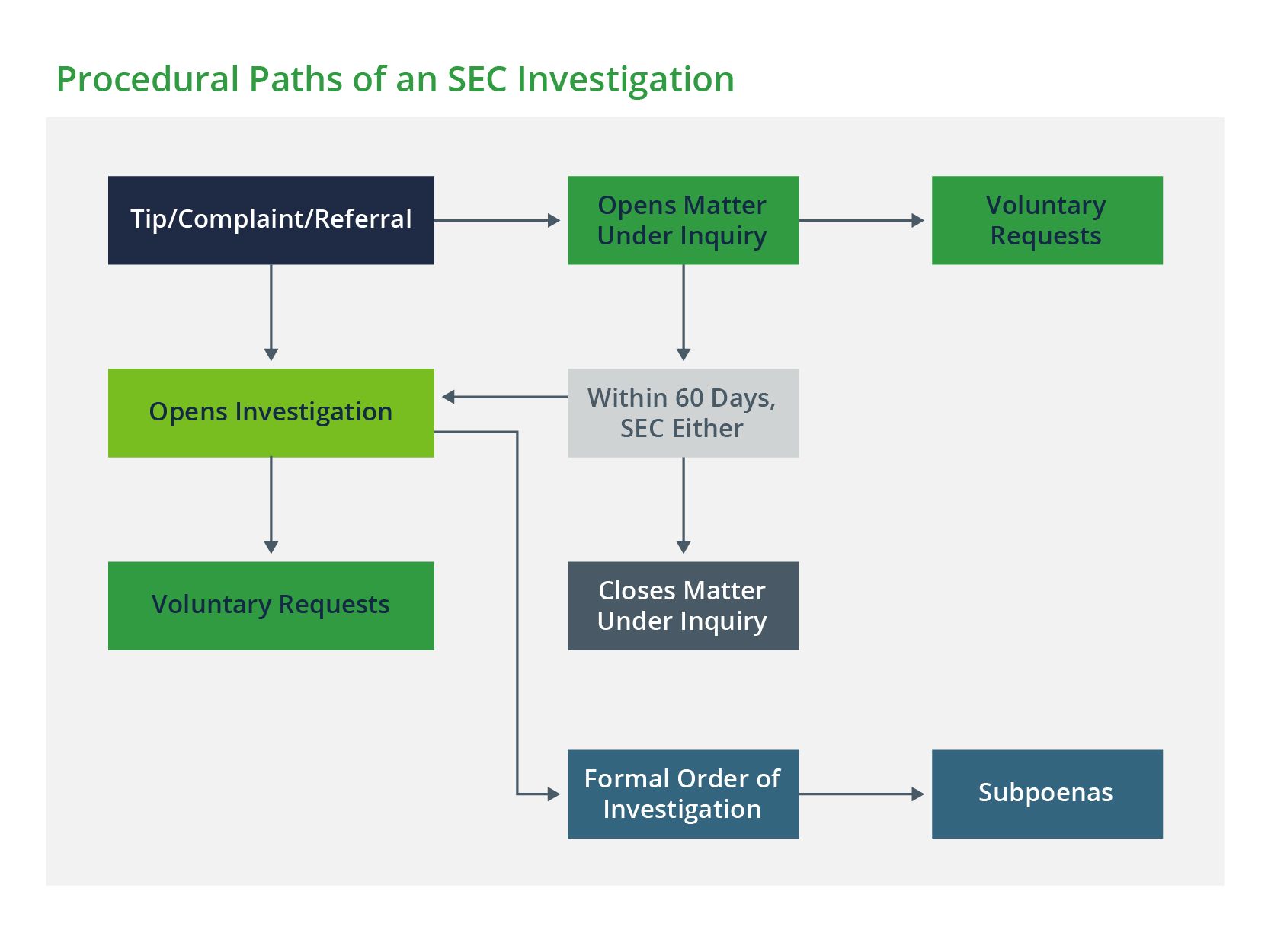

SEC Investigation and Its Ripple Effects

The Securities and Exchange Commission (SEC) didn’t take these irregularities lightly. Their investigation led to Kraft Heinz settling procurement-related allegations for $62 million. This settlement money isn’t just disappearing into government coffers; it’s being distributed to harmed investors through a Fair Fund.

Source: Woodruff Sawyer

The SEC’s involvement underscores the seriousness of the allegations against Kraft Heinz. It’s a reminder that even corporate giants aren’t immune to regulatory scrutiny.

Lead Plaintiffs and Class Certification

In class action lawsuits like this, the role of lead plaintiffs is crucial. They represent the interests of all affected investors and play a key role in shaping the litigation strategy. In the Kraft Heinz case, Union Asset Management Holding AG, a German investment firm, was appointed as one of the lead plaintiffs.

Why Union Asset Management? They had significant holdings in Kraft Heinz and suffered substantial losses due to the alleged misconduct. Their involvement brought an international perspective to the case and highlighted the global impact of Kraft Heinz’s actions.

The Union Asset Management Holding AG Factor

The appointment of Union Asset Management as a lead plaintiff wasn’t just a procedural detail; it shaped the entire trajectory of the lawsuit. Their expertise in international finance and their substantial stake in the outcome ensured that the interests of a diverse group of investors were represented.

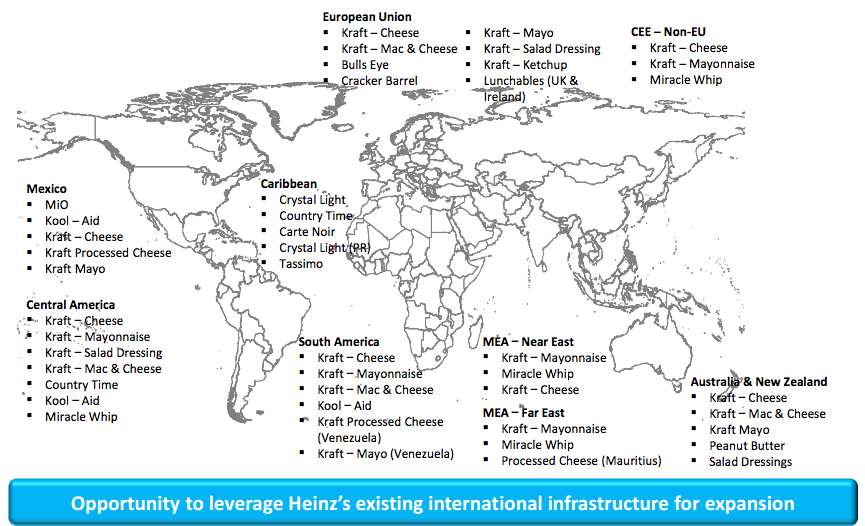

Source: Seeking Alpha

This image, while from an earlier period, illustrates the kind of optimism that many investors, including Union Asset Management, had about Kraft Heinz before the accounting irregularities came to light. The contrast between this optimism and the subsequent legal battles is stark.

The FLSA Settlement: Labor Practices Under Scrutiny

While the securities litigation was making headlines, another legal battle was brewing behind the scenes. Kraft Heinz found itself facing allegations of Fair Labor Standards Act (FLSA) violations, specifically related to overtime pay discrepancies.

Overtime Pay Discrepancies

The FLSA settlement brought to light issues with how Kraft Heinz classified and compensated its employees. Imagine a production line supervisor who’s classified as exempt from overtime due to managerial duties but spends most of their time performing non-exempt tasks. This misclassification could lead to significant unpaid overtime wages, illustrating the complexity of FLSA compliance in the food industry.

These discrepancies weren’t isolated incidents. They pointed to systemic issues in Kraft Heinz’s labor practices, raising questions about the company’s commitment to fair compensation and employee rights.

Impact on Kraft Heinz’s Workforce

The FLSA settlement had a profound impact on Kraft Heinz’s workforce. It wasn’t just about back pay; it was about recognizing the value of employees’ time and effort. For many workers, this settlement represented a vindication of their rights and a step towards fairer labor practices.

Source: Comparably

This graph shows Kraft Heinz’s Net Promoter Score, which measures customer satisfaction and loyalty. While it’s not directly related to employee satisfaction, it’s interesting to consider how internal labor issues might indirectly affect customer perception over time.

Compliance Overhaul and Future Implications

In response to the FLSA settlement, Kraft Heinz had to overhaul its compliance practices. This wasn’t a simple fix; it required a comprehensive review and revision of the company’s entire approach to labor management.

| Key Changes in Kraft Heinz Labor Practices Post-Settlement |

|---|

| Implementation of new timekeeping systems |

| Revision of job classifications |

| Enhanced training on FLSA compliance |

| Regular audits of overtime practices |

| Establishment of a dedicated compliance team |

These changes weren’t just about avoiding future legal troubles; they represented a shift in Kraft Heinz’s corporate culture towards greater transparency and fairness in its labor practices.

The Kraft Heinz Fair Fund: Compensating Affected Investors

The establishment of the Kraft Heinz Fair Fund marked a significant step in the company’s efforts to make amends with affected investors. This fund, created as part of the SEC settlement, aims to distribute the $62 million penalty to harmed investors.

Source: PR Newswire

Distribution Mechanism and Eligibility Criteria

The Fair Fund’s distribution mechanism is designed to ensure that affected investors receive compensation proportional to their losses. Eligibility criteria are strict, requiring investors to prove their holdings and transactions during the relevant period.

Proof of Claim Process

For investors seeking compensation from the Fair Fund, the proof of claim process can be daunting. Here’s a step-by-step guide to navigating this complex process:

- Gather all relevant brokerage statements

- Compile a list of all Kraft Heinz securities transactions during the claim period

- Calculate your total investment and losses

- Complete the official claim form accurately

- Attach all required supporting documentation

- Review the form for completeness and accuracy

- Submit the claim before the deadline

- Keep a copy of all submitted materials for your records

- Follow up with the fund administrator if you don’t receive confirmation

- Be prepared to provide additional information if requested

This process requires meticulous record-keeping and attention to detail. For many investors, it’s a time-consuming but necessary step towards recouping their losses.

Tax Implications of Fair Fund Payments

It’s crucial for investors to understand that Fair Fund payments may have tax implications. These payments aren’t free money; they’re considered compensation for losses and may be subject to taxation. I always advise consulting with a tax professional to understand how these payments might affect your overall tax situation.

Long-Term Impact on Investor Relations

The Fair Fund is more than just a mechanism for compensation; it’s a step towards rebuilding trust with investors. Kraft Heinz’s handling of this fund will be closely watched and could significantly impact its future investor relations.

Rebuilding Trust Through Transparency

In the wake of the accounting irregularities and subsequent legal battles, Kraft Heinz faces an uphill battle in rebuilding investor trust. The Fair Fund is just one piece of this puzzle. The company’s commitment to transparency in its financial reporting and corporate governance will be crucial in the coming years.

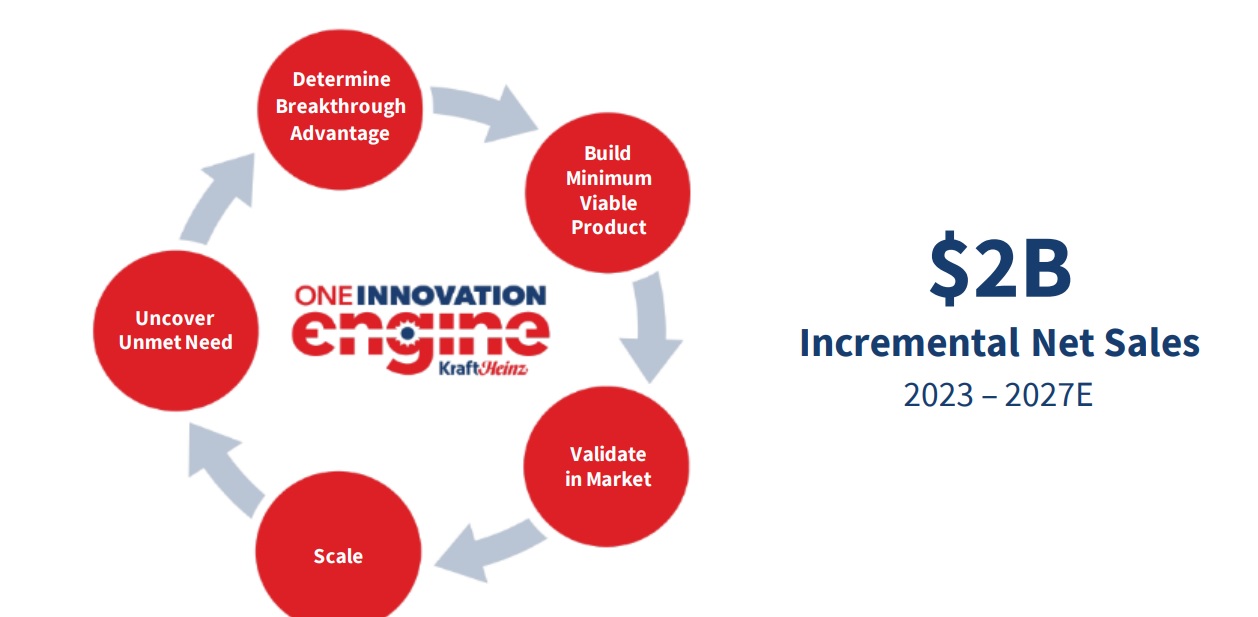

Source: William Reed

This image represents Kraft Heinz’s efforts to focus on innovation and growth post-settlement. It’s a visual reminder that the company is trying to move forward and rebuild its reputation.

Lessons for Corporate Governance and Investor Protection

The Kraft Heinz case offers a wealth of lessons for corporate governance and investor protection. It’s a stark reminder of the importance of robust internal controls, transparent financial reporting, and ethical business practices.

Enhanced Due Diligence in Mergers and Acquisitions

One of the key takeaways from the Kraft Heinz case is the critical importance of thorough due diligence in mergers and acquisitions. The goodwill impairment that triggered much of the legal action was largely related to the 2015 merger between Kraft and Heinz.

This case underscores the need for companies to look beyond surface-level financials when considering major acquisitions. It’s not just about the numbers on the balance sheet; it’s about understanding the true value and potential risks of the assets being acquired.

The Role of Board Oversight

The Kraft Heinz case also highlights the crucial role of board oversight in preventing accounting irregularities and ensuring compliance with securities laws. Effective board oversight requires a combination of financial expertise, independence, and a willingness to ask tough questions.

In the aftermath of this case, many companies are reevaluating their board structures and oversight mechanisms. It’s no longer enough to have a board that rubber-stamps management decisions; today’s boards need to be actively engaged in risk management and compliance oversight.

Evolving Shareholder Activism Strategies

The Kraft Heinz case has also influenced shareholder activism strategies. Investors are becoming more proactive in demanding transparency and accountability from the companies they invest in. This shift is changing the dynamics between corporations and their shareholders, leading to more engaged and sometimes contentious relationships.

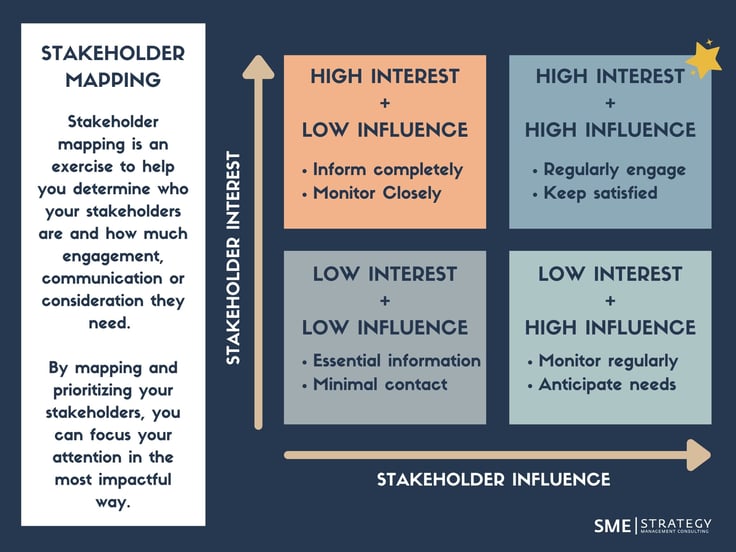

Collaborative Engagement vs. Adversarial Litigation

One interesting development in the wake of cases like Kraft Heinz is the growing preference for collaborative engagement over adversarial litigation. Many institutional investors are finding that they can achieve better outcomes by working with companies to improve governance practices rather than immediately resorting to lawsuits.

Source: SME Strategy

This image illustrates the concept of stakeholder engagement, which is becoming increasingly important in the post-Kraft Heinz era of corporate governance. Companies are realizing that engaging with shareholders and other stakeholders proactively can help prevent the kind of crisis that Kraft Heinz faced.

Learnings Recap

As we wrap up our deep dive into the Kraft Heinz class action lawsuit, let’s recap some of the key learnings:

- Corporate governance and financial reporting practices are essential for maintaining investor trust and avoiding legal complications

- Class action lawsuits and regulatory investigations can have far-reaching consequences for companies, impacting stock prices, labor practices, and more

- Investors should remain vigilant and informed about the companies they invest in, paying close attention to financial disclosures and corporate governance practices

- The resolution of complex legal cases often involves multiple components, including securities litigation, labor settlements, and investor compensation funds

- Transparency and proactive communication are crucial for companies seeking to rebuild trust and maintain strong relationships with shareholders and employees

The Ripple Effect: Industry-Wide Implications

The Kraft Heinz case didn’t occur in a vacuum. Its repercussions have been felt across the food industry and beyond, prompting companies to reevaluate their financial practices and governance structures.

Regulatory Response and Policy Shifts

In the wake of the Kraft Heinz case, regulatory bodies have become increasingly vigilant. The SEC, in particular, has signaled a renewed focus on financial reporting accuracy and the valuation of intangible assets like goodwill.

This regulatory shift isn’t just affecting large corporations. Even smaller companies are feeling the pressure to

This regulatory shift isn’t just affecting large corporations. Even smaller companies are feeling the pressure to enhance their financial reporting practices and internal controls. It’s a reminder that in today’s interconnected business world, the actions of one industry giant can have far-reaching consequences.

The Role of External Auditors

The Kraft Heinz case has also put a spotlight on the role of external auditors. Questions have been raised about how such significant accounting irregularities could have gone undetected for so long. As a result, many companies are reevaluating their relationships with auditing firms and demanding more rigorous scrutiny of their financial statements.

This increased scrutiny isn’t just about catching errors; it’s about fostering a culture of transparency and accountability. External auditors are now expected to play a more proactive role in identifying potential issues before they escalate into full-blown crises.

The Human Element: Employee Whistleblowers and Corporate Culture

While much of the focus in the Kraft Heinz case has been on financial metrics and legal proceedings, it’s important not to overlook the human element. Employee whistleblowers often play a crucial role in bringing corporate misconduct to light. The Kraft Heinz case underscores the importance of fostering a corporate culture where employees feel empowered to speak up about potential wrongdoing. Companies that prioritize ethical behavior and provide clear channels for reporting concerns are better positioned to avoid the kind of scandal that engulfed Kraft Heinz.

Psychological Impact on Investors and Employees

The fallout from corporate scandals like the Kraft Heinz case extends beyond financial losses. There’s a significant psychological toll on both investors and employees. For investors, the sudden loss of value in their holdings can shake their confidence in the market as a whole. Employees, meanwhile, may grapple with feelings of betrayal and uncertainty about their future with the company.

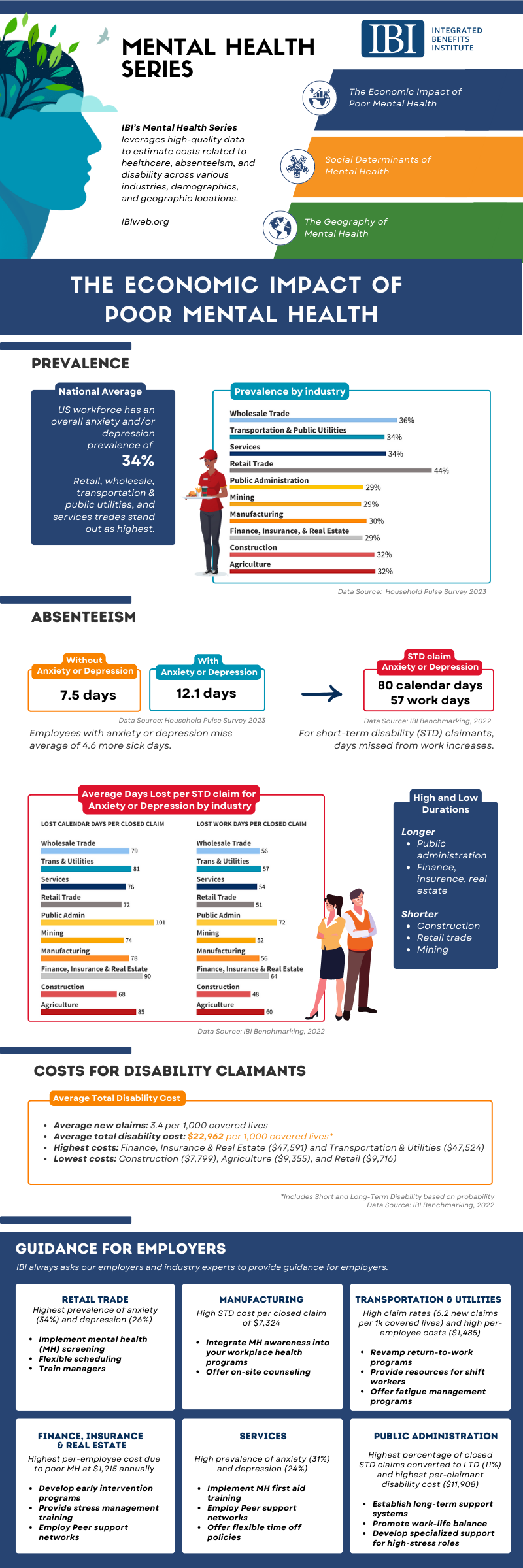

Source: IBI Web

This infographic illustrates the broader economic impact of poor mental health, which can be exacerbated by corporate scandals and the resulting workplace stress.

The Road to Resolution: Negotiation and Settlement Dynamics

Resolving complex corporate litigation like the Kraft Heinz case involves intricate negotiation and settlement dynamics. These processes often occur behind closed doors, with teams of lawyers and financial experts hammering out the details of settlements that can run into hundreds of millions of dollars.

The Role of Insurance in Corporate Litigation

Directors and Officers (D&O) insurance plays a crucial role in cases like Kraft Heinz. These policies can cover the costs of legal defense and settlements, potentially saving companies from financial ruin. However, the Kraft Heinz case has prompted many insurers to reevaluate their underwriting practices for D&O policies, potentially leading to higher premiums and more stringent terms for companies in high-risk industries.

Shareholder Derivative Actions: A Parallel Legal Front

Alongside the class action lawsuit, Kraft Heinz also faced shareholder derivative actions. These lawsuits, brought by shareholders on behalf of the company against its directors and officers, add another layer of complexity to corporate litigation. They often focus on allegations of breach of fiduciary duty and can result in changes to corporate governance practices.

Looking Ahead: The Future of Corporate Accountability

The Kraft Heinz case has set new precedents for corporate accountability and investor protection. As we look to the future, it’s clear that companies will need to adapt to a landscape of increased scrutiny and higher expectations for transparency and ethical behavior.

The Global Perspective: International Ramifications

The international scope of the Kraft Heinz case, with its German lead plaintiff and global investor base, highlights the increasingly interconnected nature of corporate accountability. Companies operating in multiple jurisdictions must navigate a complex web of regulations and cultural expectations, making global compliance a top priority for corporate leadership.

The Next Generation of Corporate Leaders: Lessons Learned

For the next generation of corporate leaders, the Kraft Heinz case serves as a cautionary tale and a learning opportunity. Future executives will need to prioritize ethical leadership, robust internal controls, and proactive stakeholder engagement to avoid similar pitfalls.

The Kraft Heinz class action lawsuit is more than just a legal case; it’s a watershed moment in corporate governance. Its repercussions will be felt for years to come, shaping how companies operate, how investors evaluate risk, and how regulators approach their oversight responsibilities.

At Ultra Law, we’re committed to helping individuals navigate the complexities of corporate litigation and its impact on personal finances. While our primary focus is personal injury law, we understand that legal challenges can take many forms. If you’re grappling with questions about your rights as an investor or employee in the wake of corporate misconduct, we’re here to provide guidance and support.

Our team stays informed about developments in corporate law and securities litigation to offer knowledgeable advice to our clients. We believe that understanding these complex cases is vital for anyone seeking to protect their interests in today’s interconnected financial world.

Don’t let the intricacies of corporate litigation leave you feeling overwhelmed. Reach out to Ultra Law today, and let’s discuss how we can help you understand your rights and options in the face of corporate misconduct or financial irregularities.