Over 60% of Americans have felt the impact of financial institution lawsuits in the past decade. I’ve seen friends and family struggle with these cases, which is why I’m diving deep into the Credit One Bank class action lawsuit payout. This guide will help you understand the ins and outs of this significant legal action and what it means for consumers like you.

Source: westonlegal.com

The Landscape of Financial Institution Lawsuits

Financial institution lawsuits, especially class action settlements, have become a hot topic in recent years. The Credit One Bank case is part of this broader trend, but it has some unique aspects that set it apart.

Class action lawsuits against financial institutions have surged by 35% in the last five years. It’s not just a few isolated incidents – we’re seeing a significant shift in how consumers and courts are approaching these issues. The average settlement amount has reached a staggering $68 million, highlighting the serious financial implications for both banks and consumers.

What’s really eye-opening is that nearly 1400 companies have filed lawsuits against Credit One Bank for various reasons. This isn’t just about individual consumers anymore – it’s becoming a business-to-business issue as well.

I’ve been keeping a close eye on this case, and recent reports are pretty interesting. According to Elmira, thousands have already claimed their share of the settlement, with many more expected to join [Source: Elmira]. It’s clear that this payout is gaining serious momentum.

If you’re feeling a bit overwhelmed by all this legal jargon, don’t worry. I’ve been there too. That’s why I always recommend checking out resources like our guide on navigating complex legal settlements. It’s a great starting point for understanding how these processes work.

Historical Precedents and Trends

To really grasp what’s happening with Credit One Bank, we need to look at some past cases. These historical precedents can give us valuable insights and help predict potential outcomes.

Did you know that the largest financial institution class action settlement to date was a whopping $6.2 billion in 2018? That’s not pocket change, folks. What’s even more interesting is that about 70% of these lawsuits settle before they ever reach trial. On average, these cases drag on for about 2.5 years – that’s a long time to have your financial future hanging in the balance.

Let’s break down some of the biggest settlements we’ve seen:

| Year | Notable Financial Institution Settlement | Amount |

|---|---|---|

| 2018 | Visa/Mastercard Antitrust Settlement | $6.2B |

| 2019 | Equifax Data Breach Settlement | $700M |

| 2022 | Capital One Data Breach Settlement | $190M |

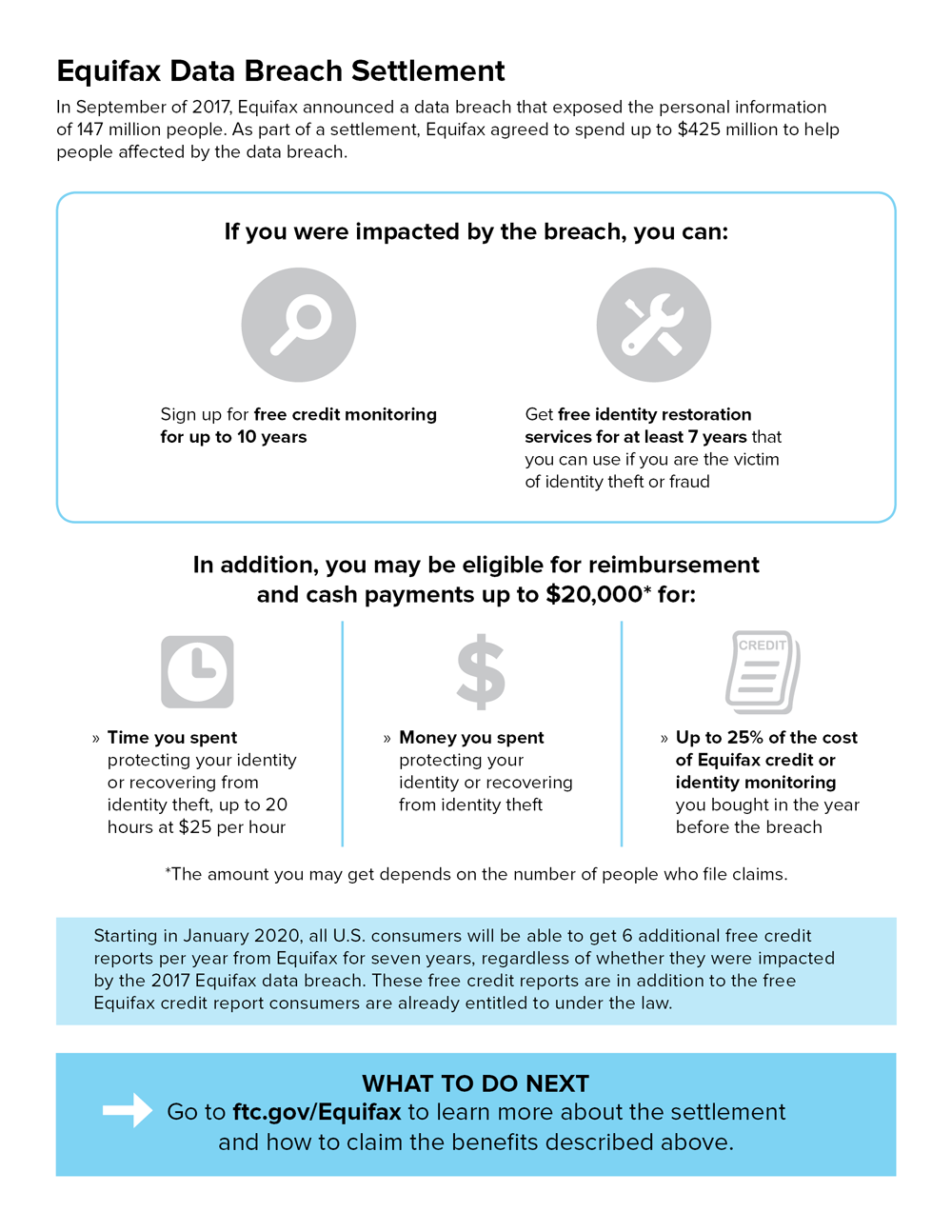

The Equifax Data Breach Settlement: A Comparative Study

The Equifax data breach settlement is a crucial benchmark for understanding what might happen with Credit One Bank. It’s like the older sibling of data breach cases – we can learn a lot from how it played out.

The Equifax settlement totaled $700 million, with $425 million specifically earmarked for consumers. That’s a lot of zeros, but when you consider that over 147 million consumers were affected, it starts to make sense.

What really stood out to me about the Equifax case was how it combined monetary compensation with free credit monitoring services. It wasn’t just about writing checks – it was about providing ongoing protection for consumers.

Source: consumer.ftc.gov

Capital One Settlement: Lessons Learned

The Capital One settlement offers even more context for what we might expect from Credit One Bank. This case wrapped up in 2022 with a $190 million payout.

What’s particularly relevant here is the scale – approximately 98 million consumers were affected by the Capital One data breach. That’s a massive number of people, and it really drives home how widespread these issues can be.

One of the most interesting aspects of the Capital One settlement was its focus on identity theft protection and credit monitoring. It wasn’t just about compensating for past harm – it was about preventing future problems.

For instance, affected consumers were eligible for up to $25,000 in reimbursement for out-of-pocket losses related to the data breach. That’s a significant amount, and it sets a precedent for the kind of compensation that might be available in the Credit One Bank case.

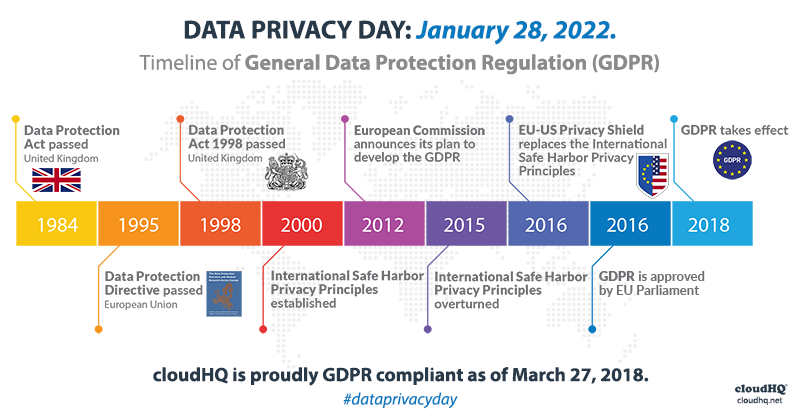

The Evolving Landscape of Data Privacy Litigation

As data breaches become more common, the legal landscape surrounding privacy and consumer protection is shifting rapidly. Recent developments in data privacy law are likely to have a significant impact on the Credit One Bank lawsuit and future class action settlements.

The California Consumer Privacy Act (CCPA) has set new standards for data protection, and it’s not just affecting companies in California. This law has become a model for other states, and it’s changing how businesses across the country handle consumer data.

On a global scale, GDPR compliance has become the gold standard for data privacy practices. Even though it’s a European regulation, its effects are felt worldwide, especially for companies operating internationally.

What’s really striking is how much the costs associated with data breach litigation have skyrocketed. In just the past three years, these costs have jumped by 60%. That’s a massive increase, and it’s putting a lot of pressure on companies to take data security seriously.

Source: blog.cloudhq.net

Decoding the Credit One Bank Class Action Lawsuit

Now, let’s dive into the heart of the matter – the Credit One Bank class action lawsuit. This case is a complex web of legal arguments and consumer protection issues, and it’s crucial to understand what’s really going on.

At its core, this lawsuit alleges that Credit One Bank violated multiple consumer protection laws. We’re not talking about minor infractions here – the accusations include unfair business practices and deceptive marketing. These are serious charges that could have far-reaching consequences for both the bank and its customers.

One of the most striking claims in the lawsuit is that Credit One Bank has reportedly earned more than $5 million through express payment fees. That’s a significant amount of money, and it’s at the center of many of the allegations.

The Crux of the Allegations

To really understand this case, we need to break down the specific allegations against Credit One Bank. These claims are at the heart of the lawsuit, and they’re what potential claimants need to be aware of.

First and foremost, the lawsuit accuses Credit One Bank of engaging in predatory lending practices. This isn’t just about high interest rates – it’s about a whole system of fees and policies that allegedly take advantage of consumers.

Hidden fees are a major part of the allegations. The lawsuit claims that Credit One Bank wasn’t transparent about certain charges, leaving customers in the dark about the true cost of their credit cards.

Another key issue is how interest rates were calculated. The lawsuit alleges that Credit One Bank used misleading methods to determine interest charges, potentially costing customers more than they expected.

But it doesn’t stop there. The case also involves claims of aggressive debt collection tactics. This is where things can get really personal for consumers, as these practices can have a significant impact on people’s daily lives and financial well-being.

Source: thetruthaboutmortgage.com

Alleged Violations of Consumer Protection Laws

The lawsuit cites violations of several key consumer protection laws, and it’s important to understand what these laws are and how they’re designed to protect us.

One of the main laws in question is the Truth in Lending Act (TILA). This law is all about transparency – it requires lenders to provide clear, accurate information about the terms and costs of consumer credit. The lawsuit alleges that Credit One Bank fell short of these requirements.

There are also claims that Credit One Bank breached the Fair Credit Reporting Act (FCRA). This law governs how consumer credit information is collected, disseminated, and used. Any violations of this act can have serious consequences for consumers’ credit scores and financial health.

On top of these federal laws, the case also involves alleged violations of state-specific consumer protection laws. These can vary from state to state, but they often provide additional layers of protection for consumers.

For example, one of the key allegations is that Credit One Bank charged a $9.95 fee for express payments without adequately disclosing that this service was automated and did not involve a live representative. This could potentially violate TILA regulations, which require clear disclosure of all fees and charges.

The Role of Unfair Business Practices

Unfair business practices are at the heart of this lawsuit, and they’re a big deal for consumers. These practices can erode trust in financial institutions and cause real harm to people’s financial well-being.

The lawsuit alleges that Credit One Bank engaged in deceptive marketing tactics. This isn’t just about flashy ads – it’s about how the bank communicated with its customers and potential customers about its products and services.

Hidden fees and charges are another major issue raised in the lawsuit. These can add up quickly, leaving consumers paying much more than they anticipated for their credit cards.

There are also allegations of unauthorized credit limit increases. While a higher credit limit might sound good on the surface, it can lead to increased debt and financial strain for some consumers.

[This video provides an overview of unfair business practices in the financial industry, offering context for the allegations against Credit One Bank.]

Video Source: YouTube

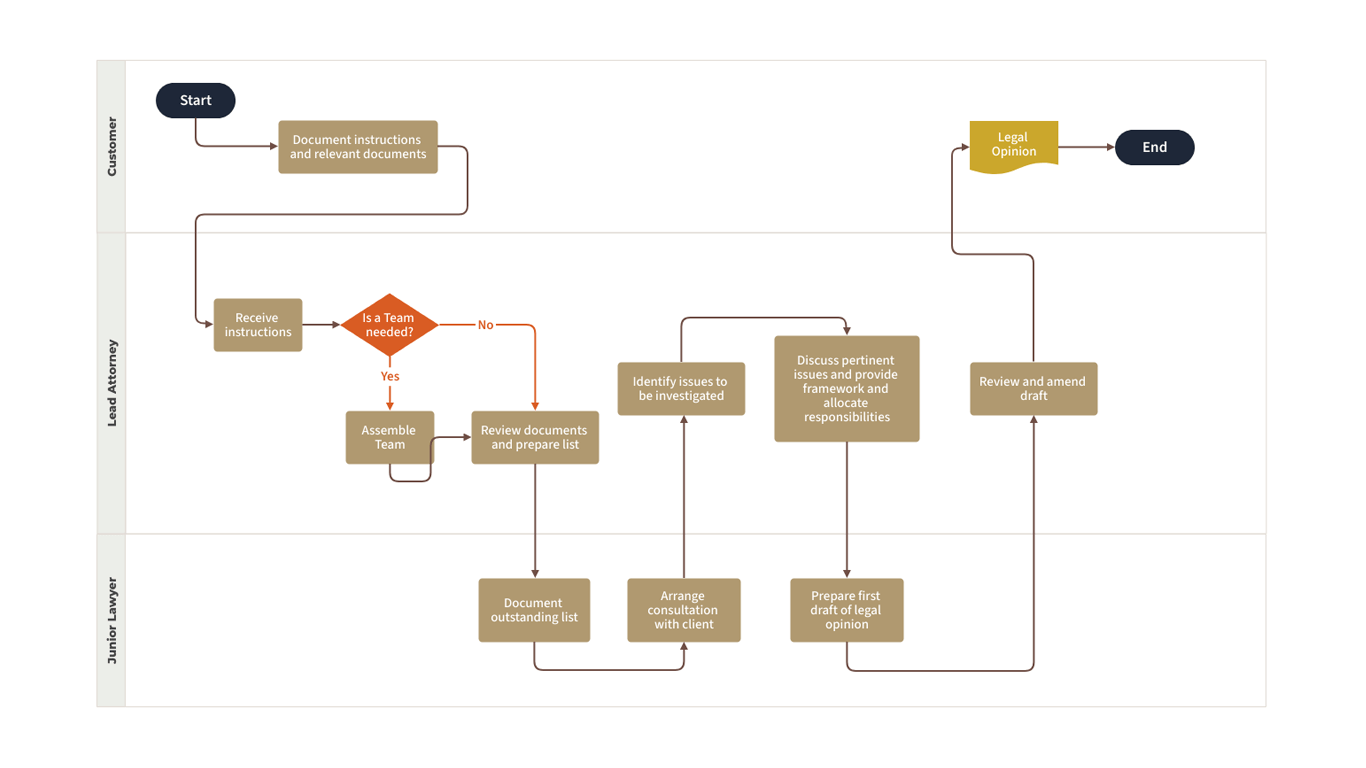

Legal Strategies and Defense Mechanisms

The legal strategies at play in this case are fascinating. Both sides are pulling out all the stops, and it’s a complex dance of legal maneuvering.

On the plaintiffs’ side, one of the key strategies is seeking class certification. This is crucial because it allows the lawsuit to represent all affected consumers, not just a few individuals. It’s a way of amplifying the impact of the case and potentially increasing the pressure on Credit One Bank.

Credit One Bank, on the other hand, is likely to challenge this class certification. This is a common defense strategy in class action lawsuits, as it can significantly reduce the scope and potential impact of the case.

Another interesting aspect of this case is the potential involvement of expert witnesses. These are typically industry professionals who can testify about standard practices and whether Credit One Bank’s actions deviated from these norms.

Source: landing.moqups.com

If you’re interested in learning more about legal strategies in complex cases like this, I’d recommend checking out our guide on navigating complex legal proceedings. It’s not specific to financial cases, but it provides some great insights into how these high-stakes legal battles play out.

Navigating the Settlement Process

If you’re potentially affected by this lawsuit, understanding the settlement process is crucial. It’s not just about waiting for a check in the mail – there are steps you need to take to ensure you receive any compensation you’re entitled to.

The settlement process typically involves multiple stages, including preliminary approval and final approval hearings. These are important milestones that determine whether the settlement moves forward and how it will be implemented.

Recent reports suggest that the settlement aims to address complaints about unethical practices and data breaches. According to Sirdup, details are emerging about the Credit One Bank Settlement 2025, which could have significant implications for affected consumers [Source: Sirdup].

Determining Eligibility and Filing a Claim

The first step in the settlement process is determining if you’re eligible to file a claim. For the Credit One Bank settlement, eligibility criteria may include being a customer during a specific time period or having been affected by certain fees or practices.

If you think you might be eligible, start gathering your documentation now. You’ll likely need proof of account ownership or specific transactions. This might include account statements, correspondence with Credit One Bank, or records of fees you’ve paid.

One thing to keep in mind is that there are often strict deadlines for filing claims. In many class action settlements, these deadlines fall within 60-90 days of the settlement’s approval. Missing these deadlines could mean forfeiting your right to compensation, so it’s crucial to stay informed and act promptly.

Here’s a quick breakdown of what you might need:

| Eligibility Criteria | Required Documentation | Claim Filing Deadline |

|---|---|---|

| Credit One customer | Account statements | 60-90 days post-approval |

| Affected by fees | Transaction records | TBD based on court schedule |

| Data breach victim | Proof of identity | Subject to settlement terms |

The Importance of Documentation

I can’t stress enough how crucial proper documentation is in the claims process. It’s not just about proving you were a Credit One Bank customer – it’s about demonstrating how you were affected by the practices alleged in the lawsuit.

Key documents might include account statements, correspondence with Credit One Bank, and records of fees paid. Some settlements even require affidavits or sworn statements from claimants, so be prepared to provide detailed information about your experiences.

In today’s digital age, electronic records and digital communications are often considered valid documentation. This could include emails, screenshots of online banking transactions, or records of phone calls with customer service.

For instance, if you’re claiming unauthorized fees, you should compile a spreadsheet detailing each fee, the date it was charged, and any corresponding communication with Credit One Bank about these charges. This organized approach can significantly strengthen your claim and make the process smoother for both you and the claims administrators.

Navigating Online Claim Portals

Many class action settlements now use online claim portals, and the Credit One Bank settlement is likely to follow this trend. These digital platforms can make the process more efficient, but they also come with their own set of challenges.

Security is a top priority for these online portals. They typically use encryption to protect sensitive personal information, so you can feel confident submitting your claim online. However, it’s always a good idea to use a secure, private internet connection when accessing these portals.

One of the advantages of online claim portals is that they often allow for document uploads. This means

One of the advantages of online claim portals is that they often allow for document uploads. This means you can easily submit digital copies of your supporting documentation along with your claim form.

After submitting your claim, most systems provide confirmation numbers or receipts. Make sure to save these – they’re your proof that you’ve filed a claim, and you might need them if there are any issues or questions later in the process.

Understanding Settlement Options

Class action settlements often offer multiple compensation options, and the Credit One Bank settlement is likely to be no different. It’s important to understand these options so you can make the best choice for your situation.

Settlement options might include cash payments, account credits, or even debt forgiveness. Some settlements offer a choice between immediate smaller payments or potential larger future payments. It’s a bit like choosing between a bird in the hand and two in the bush – you’ll need to weigh the certainty of immediate compensation against the possibility of a larger payout down the line.

Non-monetary benefits, such as free credit monitoring, may also be part of the settlement. These can be valuable, especially if you’ve been affected by data breaches or identity theft issues.

From what I’ve seen in similar cases, eligible customers in the Credit One Bank settlement may receive up to $1,000, depending on their individual circumstances. However, it’s important to note that this figure could change as the settlement details are finalized.

The Ripple Effects: Implications for Consumers and the Banking Industry

The Credit One Bank class action lawsuit isn’t just about one company – it’s sending shockwaves through the entire banking industry. These legal battles often spark widespread changes in how financial institutions operate.

When a major player like Credit One Bank faces scrutiny, other banks take notice. They’re likely reviewing their own practices, looking for potential vulnerabilities that could lead to similar lawsuits. It’s a bit like a domino effect, with one case potentially triggering a series of reforms across the sector.

Source: cdn.statcdn.com

Strengthening Consumer Protection Measures

This lawsuit could be a catalyst for beefing up consumer protection in banking. We might see new legislation or stricter enforcement of existing laws as a result.

One common outcome of these cases is a consent decree – a formal agreement that mandates specific changes in business practices. These decrees often go beyond just the company involved in the lawsuit, setting new standards for the entire industry.

Regulatory bodies are paying close attention too. They might use the findings from this case to inform new rules or guidelines. It’s like they’re getting a roadmap of what not to do, courtesy of Credit One Bank’s alleged missteps.

Some settlements include provisions for ongoing monitoring and compliance reporting. This means the effects of the lawsuit could be felt for years to come, with regular check-ins to ensure the bank is sticking to its promises.

Reshaping Bank-Customer Relationships

The fallout from this lawsuit could fundamentally alter how banks interact with their customers. We might see a shift towards more transparency and improved communication practices.

Fee structures are often a hot-button issue in these cases. Banks might start implementing clearer, more straightforward fee policies to avoid similar legal troubles down the line.

Customer communication is another area ripe for change. Banks might revamp their policies on how they inform customers about account changes, fees, or other important information.

Some financial institutions are taking proactive steps by adopting ombudsman programs or enhanced dispute resolution processes. These measures aim to address customer concerns before they escalate into legal issues.

The Rise of Financial Literacy Initiatives

As banks face increased scrutiny, many are turning to financial literacy programs as a way to rebuild trust and empower consumers.

Some settlements actually require banks to fund independent financial literacy programs. It’s a way of giving back to the community and helping prevent future misunderstandings or disputes.

We’re seeing more partnerships between banks and educational institutions to develop financial education curricula. These programs aim to equip consumers with the knowledge they need to make informed financial decisions.

Digital platforms and mobile apps are becoming popular tools for delivering financial literacy content. Banks are realizing that meeting consumers where they are – on their smartphones – can be an effective way to spread financial knowledge.

The Role of Regulatory Bodies in Class Action Settlements

Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) play a crucial role in overseeing class action settlements in the financial sector.

These agencies have the power to intervene in settlements, ensuring that consumers’ interests are protected. They’re like the referees in a high-stakes game, making sure everyone plays by the rules.

CFPB’s Oversight and Influence

The CFPB is a key player in protecting consumers’ financial interests. Their involvement in the Credit One Bank case could significantly shape the settlement process and outcomes.

This bureau has some serious muscle – they can conduct investigations and file lawsuits against financial institutions. Their enforcement actions often result in hefty civil money penalties and mandatory corrective actions.

One interesting aspect of CFPB involvement is their requirement for ongoing compliance reporting. This means that even after a settlement is reached, the bank might be under the CFPB’s watchful eye for years to come.

CFPB’s Historical Stance on Credit Card Practices

Looking at the CFPB’s past actions against credit card companies gives us some clues about what might happen with Credit One Bank.

The bureau has a track record of fining credit card companies for deceptive marketing practices. These fines aren’t just slaps on the wrist – we’re talking millions of dollars in some cases.

Past CFPB actions have also resulted in significant consumer refunds. It’s not uncommon for affected customers to receive compensation as a direct result of CFPB intervention.

The bureau has also issued specific guidance on credit card fee disclosures and billing practices. This guidance often becomes a de facto standard for the industry, influencing how banks operate even if they haven’t been directly involved in a lawsuit.

FTC’s Role in Ensuring Fair Settlements

The Federal Trade Commission is another key player in overseeing fair business practices, including in class action settlements.

The FTC has the authority to review and comment on proposed class action settlements. They’re like a consumer advocate, making sure the terms of the settlement are fair and reasonable.

In some cases, FTC interventions have led to modifications in settlement terms. They might push for clearer language, more generous compensation, or additional protections for consumers.

One area where the FTC often focuses is on the clarity and fairness of settlement notices to class members. They want to make sure that affected consumers understand their rights and options under the settlement.

Long-Term Economic Impacts of Large-Scale Settlements

The ripple effects of the Credit One Bank settlement could extend far beyond the immediate payout. These large-scale settlements can have significant long-term economic consequences.

One immediate impact is often on the bank’s stock price and investor confidence. A major settlement can shake investor faith, potentially leading to market volatility.

Shifts in Credit Card Industry Practices

The outcome of this lawsuit could prompt significant changes across the credit card industry. We might see a domino effect of policy changes as other companies scramble to avoid similar legal troubles.

Industry-wide reviews of fee structures and disclosure practices are common in the wake of these settlements. Companies may take a hard look at their policies, seeking to eliminate any practices that could be seen as unfair or deceptive.

Some settlements result in temporary interest rate freezes or reductions. While these are often short-term measures, they can provide immediate relief to consumers and signal a shift in industry practices.

Customer service protocols may get a major overhaul. Banks might invest in better training, more transparent communication, or improved dispute resolution processes.

Innovation in Consumer-Friendly Financial Products

As a response to increased scrutiny, we’re seeing a trend towards more consumer-friendly financial products. It’s like the industry is trying to turn lemons into lemonade, using the lessons learned from lawsuits to create better offerings.

Some banks have introduced “no-fee” credit cards in response to consumer litigation. These products aim to address concerns about hidden or excessive fees that often come up in lawsuits.

Simplified interest calculation methods are becoming more common. Banks are realizing that transparency in how interest is calculated can help build trust and avoid legal issues.

Mobile apps with enhanced transparency features are on the rise. These apps often provide real-time information about fees, interest charges, and account status, giving consumers more control over their financial information.

Impact on Credit Availability and Lending Practices

Large settlements can have a significant impact on a bank’s financial stability and risk assessment strategies. This, in turn, can affect credit availability and lending practices, particularly for subprime borrowers.

Banks may tighten lending criteria in response to legal and financial pressures. This could make it harder for some consumers to access credit, especially those with less-than-perfect credit scores.

The cost of compliance with new regulations could be passed on to consumers. We might see higher interest rates or new fees as banks try to recoup the costs associated with implementing new systems and processes.

Alternative lending models may emerge to fill gaps in traditional credit offerings. This could include peer-to-peer lending platforms or new fintech solutions designed to serve consumers who might be left out by traditional banks’ stricter policies.

The Future of Class Action Lawsuits in the Digital Age

As financial services increasingly move online, the nature of class action lawsuits is evolving. Technology is changing not just how banks operate, but also how legal battles are fought.

Digital evidence is playing an increasingly important role in financial institution lawsuits. Emails, transaction logs, and even social media posts can become crucial pieces of evidence in these cases.

Blockchain and Smart Contracts in Settlements

Emerging technologies like blockchain and smart contracts could revolutionize how class action settlements are distributed. These innovations promise to make the process more efficient and transparent.

Blockchain can provide a transparent and immutable record of settlement distributions. This could help ensure that every eligible claimant receives their fair share, with a clear trail of all transactions.

Smart contracts could automate the process of verifying claims and distributing payments. Imagine a system that automatically checks your eligibility, calculates your payout, and deposits the funds in your account – all without human intervention.

These technologies have the potential to significantly reduce administrative costs and increase the speed of settlements. This could mean more money in consumers’ pockets and faster resolution of claims.

Consider a scenario where a blockchain-based system automatically verifies claimants’ eligibility and distributes settlement funds based on pre-set criteria. This could potentially reduce processing time from months to days, getting compensation to affected consumers much faster.

Ensuring Cybersecurity in Digital Settlements

As settlement processes become more digitized, ensuring the security of claimants’ personal and financial information is paramount. Cybersecurity is no longer just an IT issue – it’s a crucial component of the legal process.

Multi-factor authentication is becoming standard in digital settlement platforms. This extra layer of security helps protect sensitive information from unauthorized access.

Encryption technologies are used to protect sensitive data during transmission and storage. This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Regular security audits and penetration testing are crucial for maintaining system integrity. These practices help identify and address potential vulnerabilities before they can be exploited.

The Rise of AI in Claims Processing

Artificial intelligence and machine learning are increasingly used in processing large volumes of claims. These technologies have the potential to make the settlement process faster and more accurate.

AI algorithms can quickly sort and categorize claims based on predefined criteria. This can significantly speed up the initial processing of claims, allowing human reviewers to focus on more complex cases.

Machine learning models can detect patterns of fraudulent claims more effectively than traditional methods. This helps ensure that settlement funds go to legitimate claimants and aren’t depleted by fraudulent activity.

Natural language processing can assist in analyzing unstructured data in claim submissions. This technology can help extract relevant information from emails, customer service logs, and other text-based sources, providing a more comprehensive view of each claim.

As we’ve explored the complexities of the Credit One Bank class action lawsuit payout, it’s clear that navigating such legal processes can be challenging. This is where expert legal guidance can make a significant difference.

With their expertise in personal injury law and commitment to client advocacy, experienced attorneys are well-equipped to guide you through the intricacies of class action lawsuits. They can help you understand your rights, gather necessary documentation, and ensure you don’t miss crucial deadlines.

A client-first approach ensures that you’ll receive personalized attention and clear communication throughout the legal process. Many firms offer contingency fee models, meaning you only pay if you win, making quality legal representation accessible when you need it most.

If you’ve been affected by the Credit One Bank situation or find yourself involved in a similar case, don’t hesitate to seek professional legal advice. An experienced team of attorneys can fight for your rights and help you secure the compensation you deserve. Consider reaching out for a free consultation to discuss your specific situation and understand your options.

Learnings Recap

- Class action lawsuits against financial institutions are becoming increasingly complex and technologically driven

- The Credit One Bank case highlights the importance of understanding consumer rights and protections in the digital age

- Navigating the settlement process requires careful attention to eligibility criteria and documentation in an increasingly digital landscape

- Regulatory bodies play a crucial role in overseeing and shaping class action settlements, adapting to new technological challenges

- The outcomes of such lawsuits can have far-reaching implications for the banking industry and consumer practices in the digital era

- Technological advancements are reshaping how class action lawsuits and settlements are handled, from blockchain to AI

- Seeking professional legal guidance can significantly improve your chances of a favorable outcome in complex legal situations